Key Takeaways:

Current Price: $188 Price Target: $215 (NEW, prior $220)

Position Size: 2.18% 1-year Performance: -20%

Even though 3M had announced last quarter that 3Q18 sales would see the lowest sales growth of the year, the reported number was below expectations. The pull forward of 3Q18 sales into 2Q18 had its impact as previously highlighted by the company (due to the ERP roll-out in the US). In addition, the following items had a negative impact on sales growth this quarter:

· China’s growth slowed down, especially in industrials

· Lower roof granules demand by shingles manufacturers decelerating production

· An impressive 25% decline in the drug delivery business due to less pharma R&D spending and regulatory cycle

Regarding the Healthcare segment, the management team highlighted that the other businesses were performing well. The drug delivery business is also seeing a strong pipeline for 2019, so a rebound in this category is expected going forward. During the call, it was explained that this business is project-based, and thus more volatile than other healthcare operations they have.

In their consumer segment, the home improvement business had positive low-single-digit sales growth, while all other businesses experienced a decline. Lower demand in Asia Pac and inventory destocking by retailers had a negative impact. As the “office” stores and traditional retailers restructure their operations to a different sales channel (brick-and-mortar to online…who hasn’t heard of Amazon?), inventory have seen that destocking effect. The management team suspects this will continue going forward.

Free cash flow was up 24% y/y, and 3M returned $1.9B to shareholders ($1.1B in share repurchases and $794M in dividends). ROIC is expected to be 20% for 2018. Contrary to last quarter where tariffs had little impact on earnings, the management team now actively looks at ways to change its supply chain, as raw materials costs climbed during the quarter. This should totally be offset by pricing action in the coming months. We are lowering our price target by ~2% to account for slower growth.

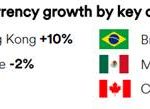

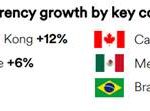

3Q18 geographic growth: 2Q18 geographic growth (for comparison):

2018 guidance update:

· Organic growth lowered to 3%, vs. 3-4% sales previously announced (M&A flat vs. +1% prior, FX flat vs. +1% prior).

· Adjusted EPS guided down to $9.90-10.00 from $10.20-10.45 previously. The higher end of the EPS guidance was reduced by 10 cents due to lower FX benefits and the sale of its Communications business.

· 20%+ ROIC – unchanged

· FCF conversion lowered to 90-95% from 90-100%

Thesis on MMM:

• Strong brand name, history of successful innovation, scale and low cost advantage help to drive above average returns.

• International expansion and pipeline investment should drive mid-single digit top line and high single digit bottom line growth. Emerging markets represent 47% of sales today and should reach 50% by 2020.

• The company is in good financial position and has a strong history of share buybacks, dividends and acting in the best interest of the shareholder.

• Quality management team with a decent incentive structure.

[tag MMM] $MMM.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109