Key takeaways:

Current Price: $309 Price Target: $388 NEW (old $374)

Position Size: 3.11% 1-year Performance: -3.6%

This week LMT released their 3Q18 earnings with sales +16% y/y (including an extra week vs. last year), operating margin +200bps y/y, and EPS +55%. Next quarter’s organic growth will not be as impressive, as the company is guiding to -1.4%, again due to calendar effect (+/- 1 week). Lockheed introduced its initial 2019 guidance. While the sales growth is above consensus numbers, the margins are slightly below, due to lower JV income in Space Systems. LMT typically increases its guidance throughout the year, and we expect them to do so again in 2019. For example, in October 2017, the sales growth guidance was 2%, and is now 6%, while margin was initially 10.3-10.5% and now 10.9%. Key positives items supportive of LMT growth are:

· The US Defense budget should continue to grow supported by continued security threats. Other countries see increase in spending as well: India, China and Japan. Europe’s defense budget is increasing as well, pressured by the US to spend more on military expenditures

· Accelerating F-35 production

· Ramp-up of Sikorsky’s CH-53K program (the aircraft’s name is “King Stallion”…who thought of that name? Rambo?): https://www.lockheedmartin.com/en-us/products/sikorsky-ch-53k-helicopter.html . The current pipeline is for 200 helicopters worth $25B

· Missiles: production capacity is being expanded as inventory level were shrinking and demand was well above production

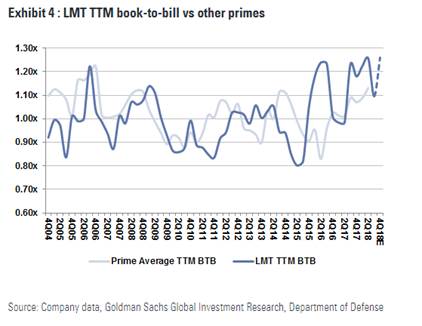

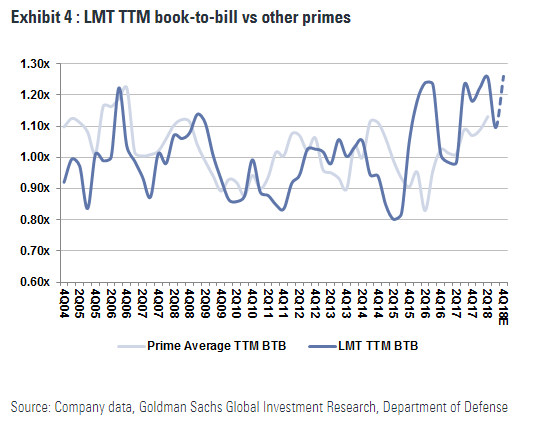

· Overall a healthy book-to-bill ratio (most likely to be at 1.25x by year end) – above 1 showing greater future demand than items currently shipped – is reassuring for 2019’s growth trajectory

· Strong balance sheet: net debt/EBITDA is down to 1.5x following the Sikorsky’s acquisition. This leaves room for LMT to do more deals

We updated our model and now see a $388 price target.

[more]

2018 guidance update:

Sales $53B (vs $51.6-53.1B prior guidance)

Operating margin $5.8B (vs. $5.575-5.725B prior)

EPS $17.50 (vs. $16.75-17.05 prior – $0.40 from better operational results, $0.20 from tax rate)

FCF should improve in 4Q as pension headwinds end (they are typically important for Defense companies)

Initial 2019 Guidance:

Sales growth 5-6% (current consensus is 5.2%)

Operating margin 10.5-10.8%, below consensus at 10.9%. The 10-40bps decline in margin is due to the loss of the JV income and mix (a growing number of new program starts next year)

$1B share repurchases

FCF will be affected by the new programs starts in 2019-2020, increasing the need for working capital.

LMT Thesis:

· Lockheed Martin is a primary beneficiary from the replacement cycle for aging military aircraft and ships

· Excellent management team focused on returning capital to shareholders

· Strong cash flow and financial position

[category earnings] [tag LMT] $LMT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109