Key Takeaways:

Current Price: $140 Price Target: $145

Position Size: 2% 1-year Performance: +27%

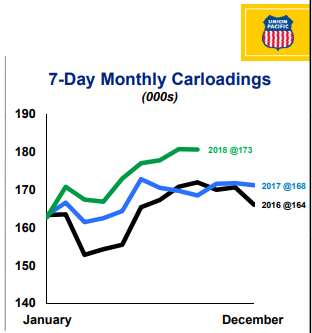

UNP reported revenue growth of +9.6% (total car load volume +5.9%, average price +3.9%), an operating ratio of 61.7% impacted by core price deceleration and 2% negative mix (23% frac sand volume decline). Tariffs impacted agriculture products exports (grains) so the company didn’t experience the usual increase in volume for this time of year. A disappointment year-to-date has been lower savings then initially targeted ($45M vs $300-350M announced early 2018). Operating ratio will not improve in 2018, but should in 2019 from productivity improvements (see comments below). On the positive side, UNP didn’t loose time implementing its PSR principles, starting with the deteriorating frac sand segment, which should improve economics. UNP also sees room to improve its network as they currently have low track densities vs. competitor BNSF. So far we remain skeptical on UNP’s ability to improve its operating ratio next year as they implement the PSR principles and will keep monitoring the progress they make.

UP 2020 plan update:

+$500M productivity improvements in 2019 thanks to lower employee expenses and benefits of running smaller locomotive and car fleet – which is achievable regarding of volume growth (to us this is a "show me" story)

Accelerated share buyback program to $20B through 2020 (was 410.6B in the past 3 years)

Segment comments:

· Agriculture: sales +6.6%, volume +5.9%, revenue per car/unit +0.7%

· Energy: sales +8.3%, volume +2.3% revenue per car/unit +5.9%

· Industrial: sales +6.9%, volume +3.2% revenue per car/unit +3.6%

· Premium (includes intermodal & auto): sales +16.8%, volume +8.4% revenue per car/unit +7.7%

Valuation: price target $145 unchanged

· The company continues to return capital to shareholders, buying back $4B shares in 2017 (4% reduction in share count), and distributing ~$2B in dividends (2% yield)

· The balance sheet is still solid, with leverage below 2x

Investment Thesis:

1. Pricing power: Railroads offer 4x the fuel efficiency of trucking per ton-mile of freight – a secular tailwind

2. History of compelling long term shareholder returns

3. Industry leading operating ratio and improving ROIC driving returns to shareholders via dividends/buybacks. Real shareholder yield of 6.5% (2.5% dividend yield, 4% buyback)

[tag UNP] $UNP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109