Key Takeaways:

Current Price: $47 Price Target: $61

Position Size: 1.26% 1-year Performance: -3%

Sensata (ST) reported strong 3Q18 earnings, with sales up +7.9% on an organic basis and adjusted EPS up +12.3%. The sales result is a clear testimony of Sensata’s secular content growth opportunity, and its ability to offset the well-publicized auto industry slowdown. The company raised its 2018 organic revenue growth guidance to 7% from 6%. EBIT margin should improve in 4Q as the recent quarters were impacted by new product launches, design and tariffs costs. The management team estimates that the recent Gigavac acquisition will help double the value of its content per electric vehicle. The company completed its $400M share repurchase program and initiated a new $250M authorization. This quarter reinforced our positive view on the name.

Segments review organic growth:

· HVOR: sales +19.8%, with strength balanced across geographies. This segment outgrew the underlying market growth rate by 1020bps. Growth drivers: need for cleaner and more efficient engines, transition to electrified cabins

· Industrial & others: sales +4%, with aerospace the strongest sub-segment (up HSD)

· Auto: sales +6.8% with strength in North America and China on content gains. This is an acceleration from the +3.9% last quarter. This segment outgrew the underlying market growth rate by 940bps. Growth should continue in 2019

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

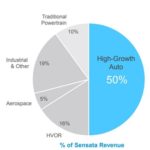

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

$ST.US

[tag ST]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109