Key Takeaways:

Current Price: $77.77 Price Target: $90

Position Size: 2.25% 1-Year Performance: +10.3%

The stock is up today after releasing good Q3 earnings results, and positive comments regarding their Aetna acquisition. Total sales were up +2.4%, and EPS +15.5% (mostly on lower tax). CVS’s PBM retention rate for next year remains high at 98% (previous number was ~95%), showing that the AET deal is not disrupting their PBM business at this point. 2018 guidance on CVS’s core business was reiterated, but 4Q results should be diluted by the AET deal costs. The Aetna transaction should close before Thanksgiving, and CVS’s management team seems incrementally more positive on the level of expected synergies (now to exceed $750M). Synergies will come from reduction in corporate expenses, integration of operations and medical costs reduction (integration of pharmacy and medical claims, leveraging the clinical data and utilizing CVS’s community assets: points of distribution and health professionals). The overall goal will be to reduce expensive hospital admissions and provide better management to the complex chronic disease cases. CVS will provide clearer details on the combined entity’s earnings guidance in February 2019. The Analyst day will also move to June (from December). Overall we remain positive on the name.

3Q18 results summary:

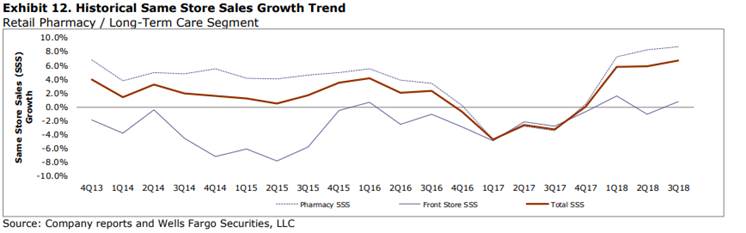

· Revenue +2.4%: PBM +2.6% (claims volume & brand inflation, similar to last quarter), Retail/LTC +6.4% (pharmacy SSS +8.7% thanks to strong volume, and front store SSS +0.8%), MinuteClinic revenue +14.5%

· Gross margin +10bps on better mix but still pressured by reimbursement rate

· Adjusted operating margin -30bps due to increased investments in the business

Positive same-store-sales trend continues:

Valuation: we are maintaining our price target of $90.

Thesis on CVS

- Market leader: largest pharmacy benefit manager (PBM) in the US. This gives CVS scale advantage and negotiating power with pharma companies to obtain better drug pricing discounts. Also the largest US pharmacy retailer, giving it more touch points with consumers/patients. Finally, market share leader in long-term care pharmacy sector thanks to its Omnicare acquisition.

- Stable and predictable top line and margin profile. CVS benefits from an ageing population in increasing needs of prescription drugs.

- shareholder friendly, offering a 7% shareholder yield (5% share repurchase + 2.6% dividend yield)

$CVS.US

[tag CVS]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109