Current Price: $2,007 Price Target: $2,400

Position Size: 2.5% TTM Performance: 20%

· Key Takeaways:

1. Beat on revenue, missed on EPS. Miss driven largely by higher ad spend.

2. Strong Q3 room night growth of 13%, well ahead of guidance.

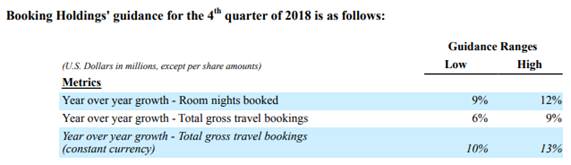

3. Strong Q4 guidance for room nights, revenue and EPS.

4. Increased ad spend helped re-accelerate growth.

· Bookings of $24.3B were better than expected (+14% constant currency) and an acceleration from last quarter. This is important as bookings guidance was a disappointment last quarter. Management blamed weak trends on the World Cup and unseasonably warm weather in Europe. They saw an acceleration after they reported 2Q results.

· Part of the disappointment last quarter was weak room growth that was somewhat self-inflicted. Room night growth slowed previously due to reduced programmatic ad spend….and maybe some weather like they said. They’ve since increased ad spend (which contributed to the EPS miss). Ad spend has been part of their engine of growth and their ability to spend at scale has enabled their success. They spend back more than a third of their revenue on advertising. That’s over $4B. Expedia does the same thing. They have been trying to “optimize” this for several quarters by spending less on performance advertising (e.g. Google AdWords) and more on brand advertising (e.g. TV commercials). The idea is that brand advertising drives direct traffic to their site, resulting in a higher ROI. This ad spend/rev growth algorithm will continue to be a focus going forward as clearly the relationship between growth and spend persists and their ability to shift to “higher ROI” ad spend still isn’t clear.

· The good news is direct channel mix did increase (now ~50% of booked room nights). Probably not a coincidence that they now say over 50% of their bookings come from mobile devices, as mobile traffic is more likely to be direct (via app).

· Merchant revenues are growing faster than agency revenues. With merchant revs they get paid up front for the full cost of travel and hold onto the cash until remitted to the hotel/home owner (less their fee) at the travel date. Revenues from their growing home rentals business (competes w/ Airbnb) are primarily driving this as they’re booked as merchant revs. This dynamic drives a growing negative cash cycle which benefits their FCF. So, as this business grows this will be a tailwind to FCF.

· They continue to work on a local experience product through both organic investment and acquisitions (FareHarbor).

Valuation:

· They continue to generate solid FCF and growing FCF margins.

· The stock is still undervalued, trading at over a 5% forward FCF yield.

· Stable margins going forward and mid-single digit growth, leads to a DCF valuation of about $2,400.

Thesis:

1. Booking is a leading global online travel agent. Their global supply advantage drives a virtuous cycle: supply drives increased traffic and bookings and in turn more supply.

2. BKNG has several competitive advantages relative to Online Travel Agent (OTA) peers:

· Leading position in Europe is a structural advantage – market is highly fragmented and depends on OTAs for bookings

· They operate largely on an agency basis which allows them to continue to grow their network and do so profitably

· Strong position in China/South East Asia via Ctrip and Agoda

3. Booking’s addressable market is growing driven by: 1.) Alternative accommodations 2.)

Increased penetration (growth of mobile/internet) 3.) Global growth of travel spend > GDP.

4. Their asset light “toll both” business model is characterized by high margins, low capital expenditures, and growing free cash flow. Free cash flow is expected to grow double digits over the next few years and I expect them to put this capital to good use via continued investment in their business and/or opportunistic returns of capital.

$BKNG.US

[tag BKNG]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!