BEXIX – Q3 2018 Commentary

Baron Emerging Markets Fund underperformed during the third quarter during a rough period for emerging market equities as a whole. The team points to the U.S. administration’s “America First” agenda as the main catalyst for poor performance, and believes that a truce or visible trade agreement between China and the U.S. could turn this trend around. The Baron team remains confident in its unique forward-looking and bottom-up fundamental approach and remains attuned to developing themes and opportunities.

Market Overview:

– Emerging Market equities continued to underperform the major U.S. and global indexes in the quarter and the EM market correction is now well advanced

o A key catalyst was the June transition from negotiation to provocation regarding bilateral discussions between the U.S. and China

o Late this spring the Trump administration increasingly deemphasized the more traditional and conventional advisors within his inner circle and chose to go with his gut

– Magnitude of short term under performance has exceeded expectations

o Believe this is largely due to the higher risk premium necessitated by the administration’s “America First” actions

Performance Overview:

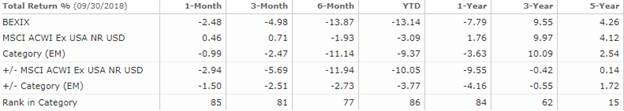

– BEXIX fell 4.98% during Q3 trailing the benchmark by almost 400 bps

– Stock selection in South African and Malaysia and higher exposure to better-performing equities in Mexico added value

– Positive effects were overshadowed by underperformance in India, China, and Russia and lower exposure to strong performing Taiwanese equities

– Favorable stock selection in consumer discretionary added to performance

o Driven mostly by position in KIA Motors Corporation of Korea

– Within communication services, lower exposure to Tencent Holdings added value

– Underperformance of investments in financials, health care, and materials and lower exposure to top performing energy sector detracted most from relative performance

o Serbank of Russia fell almost 10% due to direct threat of sanctions against Russia

o Indian financials companies came under pressure after a large government-affiliated infrastructure company received a credit downgrade

Market Outlook:

– Key question is what is the way forward and what catalysts would signal that a bottom can be formed

o In their view the way forward remains capable political leadership, productivity enhancing reforms, and an ongoing shift in emphasis toward value-added, innovative and intellectual-capital based industries

– Much of this remains largely on track though they must monitor upcoming elections in various jurisdictions for confirmation

o In the nearer term, the key market catalyst would begin with the obvious: a credible truce of transactional agreement between the U.S. and China on trade

– Any contagion to the developed markets would significantly increase the likelihood the Fed would begin to shift its rhetoric and narrow the expected magnitude and duration of its rate hike cycle

– The team remains confident in its unique forward-looking and bottom-up fundamental approach and remain attuned to developing themes and opportunities

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109