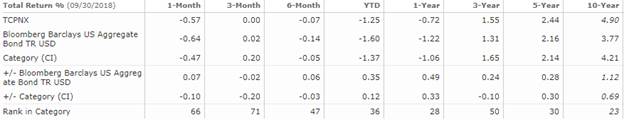

TCPNX – Q3 2018 Commentary

The Touchstone Impact Bond Fund performed exactly in line with the Agg during the quarter. The team maintains its allocations to higher quality and less economically sensitive sectors and does not take duration or curve positioning bets. The team believes that they are well positioned to take advantage of political and market headwinds.

Market Overview:

– During the third quarter, GDP growth registered a robust figure and the labor market continued to improve

– While inflation began to show some signs of life, it continued to be stable and well anchored around the Fed’s target level

o What did change was the market’s reaction to these developments

o The market reassessed its appetite for risk, and spread sectors outperformed their high-quality counterparts

– Fed raised the federal funds rate one time by 25 bps during the period

o Powell said the U.S. is in “extraordinary” economic times and espoused the view that the economy could continue to grow with the Fed’s support

– While the issuance of additional U.S. Treasuries has become necessary to fund annual government budget deficits, the Fed reduced its demand for these bonds as it normalized the size of its balance sheet

– During the quarter, interest rates on U.S. Treasuries moved higher due to an improving U.S. economy, actions by the Fed and changes to the supply/demand picture for U.S. Treasuries

– Primary headwind of rising rates was offset by the outperformance from spread products plus higher yields

o As a result the Agg outperformed Treasuries of a similar duration

Performance Overview:

– TCPNX performed in line with the Agg during the quarter

– The fund’s overweight position to spread sectors was the primary tailwind to performance during the quarter

– This was largely offset by the market’s preference for more cyclical and sensitive portions of the credit sector

– The fund’s position in Agency Multi-Family MBS provided another tailwind as the sector outperformed the Single-Family sector

– Individual security selection provided a mixture of tailwinds and headwinds to fund performance

o Position in U.S. agency bonds contributed to returns

o Overweight positions in the utilities sector and senior secured corporate bonds detracted

– The fund does not make any active interest rate bets and effective duration matched that of the benchmark at quarter end

– While changes in the yield curve can impact returns the fund attempts to remain approximately curve neutral

Market Outlook:

– Looking ahead they believe that there are many events and developments taking place that could provide opportunities for the fund

– The Fed’s normalization of its balance sheet could provide a tailwind for the fund as the portfolio is underweight both U.S. Treasuries and Single-Family MBS

– The pace of the Fed’s balance sheet has been modest at approximately $150 billion in aggregate, and the run rate is scheduled to reach upwards of $50 billion a month by the end of the year

– Unexpected volatility within the financial markets could be fueled by an increased level of leverage, tense trade rhetoric with China, concerns surrounding emerging markets, and potential liquidity implications

o Fund’s emphasis on less economically sensitive sectors and high quality could act to mitigate these impacts

– Believe the fund is positioned well and maintains a discipline that balances risk and return objectives

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109