HILIX – Q3 2018 Commentary

The Hartford International Value Fund had a strong quarter, returning over 1.5% and outpacing its benchmark. The team remains focused on finding companies with low prices, low expectations, and low valuations. On an absolute basis, value has underperformed growth but the Hartford fund continues to outperform its peer group on a long term relative basis.

Market Overview:

– The MSCI International Value index posted positive returns for the third quarter

– Global markets stabilized in the wake of robust United States economic data

o Political uncertainty and trade concerns weighed on other areas

– U.S. and China trade relations remained volatile as U.S. tariffs on $200 billion took effect in September

o China promptly retaliated with tariffs on about $60 billion of U.S. exports

– EM volatility spiked after Turkey’s financial crisis rattled global markets but receded at the end of the quarter

– Oil approached a four year high amidst global supply uncertainties

– On the monetary front, the Fed, Bank of England, and Bank of Canada raised interest rates while the ECB remained dovish

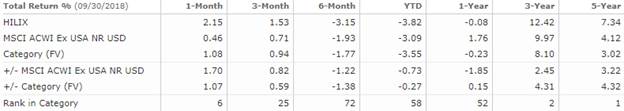

Performance Overview:

– HILIX outperformed its benchmark during the period

– Performance was driven by positive sector allocation as the fund’s underweight in real estate and overweigh in tech proved beneficial

o This was partially offset by an underweight in healthcare, which detracted

– Stock selection effects were neutral during the period

o Strong selection within energy, healthcare, and telecom was offset by weaker selection in financials, materials, and informational technology

– From a style perspective, the approach continued to face a style headwind with growth outperforming value modestly

– Among the top contributors during the period were Saipem and Air France

– GAM Holdings and Gold Fields Limited were among the top relative detractors during the period

Market Outlook:

– The team continued to focus on opportunities that fit into our framework of looking for stocks with low relative price, low expectations, and low valuations

o Consistent with recent prior periods, information technology and consumer discretionary remain the largest overweight exposures with financials and healthcare as the largest underweights

– Initiated a position in Maxwell Holdings, an electronics maker based in Japan

o The stock is near a 10 year valuation low

– Initiated position in Kingfisher, a U.K. based multinational home improvement retailer

o Stock is trading at 10-year relative valuation low after pressure from concerns around Brexit

– Eliminated Almirall SA, a Spain-based manufacturer of pharmaceuticals applied in various areas

o Exiting after the stock tripled and they began trimming last year

– Exited Storebrand, a Norwegian financial services company that we have owned since 2012

o Have held the name for three years before it finally began outperforming

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109