Good Morning,

Attached is the most updated Monthly Market Monitor from Eaton Vance. I have included a few of the most relevant graphs below.

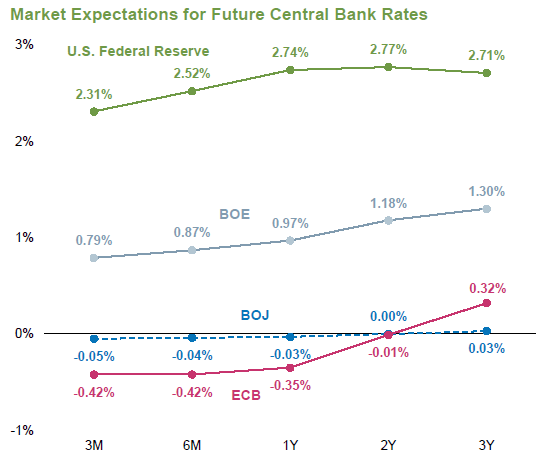

Monetary Policy: The Fed has continued to increase rates, and the U.S. increases the spread as the highest government bond yields of any major developed country.

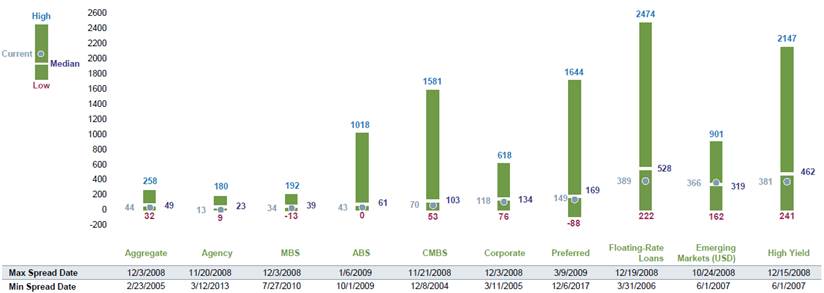

Fixed Income Spreads: based purely on spreads, no asset class that currently appears “cheap”.

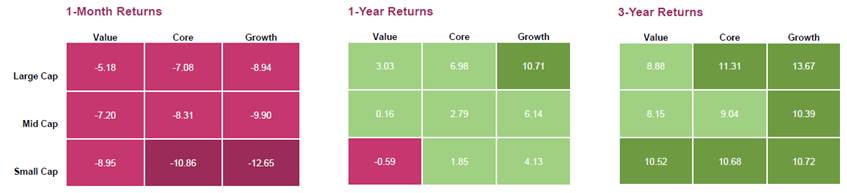

Equity Market Returns: Quantifying the difference between value and growth over the past 3 years

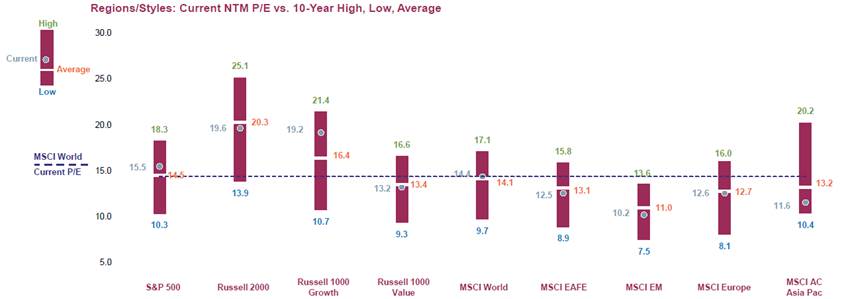

Global Equity Valuations: U.S. equities are no longer as expensive as they were one year ago. On a relative basis, emerging markets and international developed indices are trading at lower multiples.

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109