HLMEX – Q3 2018 Commentary

The Harding Loevner Emerging Market Fund underperformed the broad emerging market index during the quarter as we saw value outperform growth for the first time in nearly two years. Negative performance was driven by the more growth oriented names in the portfolio, specifically those in China. Much of the benchmark’s performance hinges on China, and the team believes that they are positioned defensively to combat regulation while still taking advantage of the growth opportunity China does offer.

Market Overview:

– Emerging markets stocks fell nearly 1% during the quarter primarily due to worries over China and sharp currency weakness

o Fears early in the period of widespread sell-off due to rising U.S. interest rates and the strengthening dollar were not realized

– The Chinese market has fallen about 20% since its high in January

o Its economic momentum has been slowing for much of the year as a side effect of the government’s efforts to reduce its reliance on borrowed money

– An escalating trade war with the U.S. is beginning to have an impact as Chinese firms postpone new capital investments

– A tightening of regulation over health care, online games, and social media – home to some of China’s fastest-growing businesses, whose stock fell in the face of the implied structural threat

– In Turkey, financial stresses erupted into a full-blown crisis

o The lira fell 24% in the quarter and has fallen nearly 40% this year

– Outside the drama in China and Turkey, 14 of 24 countries in the index recorded positive returns in dollar terms

– Broadly, EM equities exhibited a notable style shift this quarter with growth stocks underperforming value for the first time since the fourth quarter of 2016

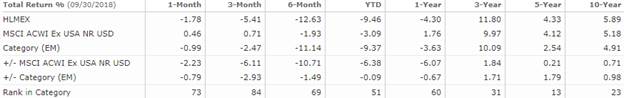

Performance Overview:

– HLMEX fell almost 5% during the quarter, underperforming its benchmark

– During the quarter, performance was affected by sever growth-style headwinds as the fastest-growing stocks in EM underperformed, particularly in China

– During the quarter our performance was affected by severe growth-style headwinds as the fastest-growing stocks in EM underperformed

o Applying their proprietary growth rank methodology, found the preference for high-growth stocks across all regions accounted for approximately half of underperformance in the quarter

– The fund had negative selection effects in 7 out of 11 sectors during the quarter

o Health care, industrials, financials, and tech hurt the most

– Consumer discretionary was a modest positive contributor

– From a geographic perspective, the fund lagged most in Asia consistent with the acute underperformance of growth stocks in the region

o China detracted over 200 bps form our relative returns

– The fund had strong performance in Latin America thanks to contributions from Mexican holdings

Market Outlook:

– At a major economic conference in December 2017, Chinese President Xi Jinping and other leaders stressed the need for high quality development of China’s economy

– Changes in China’s regulatory landscape are to be expected as part of its continued development

o However, the team cannot have confidence in predicting regulators’ actions and their timing

– Certain areas of increased regulation include health care and drug prices, online games, and social media

– The team believes that Xi and his leadership team understand the importance of companies like Hengrui and Tencent to the success of the government’s plans to transform China’s economy

o They believe that their chosen companies can defend their profits amid these new uncertainties and take advantage of the growth opportunities that China does offer

– New purchases in the quarter included three financials companies, a Belarus IT company, and a South Korean air and water purifier manufacturer

– Sales included a Taiwanese PC manufacturer, a Hungarian pharmaceutical company, and a South Korean home-furnishing retailer

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109