3M held its annual Investor Day late last week. This was the new CEO Mike Roman’s first Investor Day at the helm of the company. The 5-year 2019-2023 plan overall didn’t change much.

The management team adjusted its total organic growth up from 2-5% to 3-5%, outpacing the global economic growth of 2-3%. Each segment’s growth expectations are below:

o Consumer 2-4%

o Health Care: 4-6%

o Safety & Graphics: 3-6%

o Industrial 3-5%

o Electronics & Energy 2-6%

§ Most product pruning has been accomplished, so the focus is now on the 12 priority opportunities: wound care, population health, automotive electrification, connected road, food safety, biopharma filtration, connected safety, structural bonding, surface finishing, air quality, grid modernization, custom orthodontic.

§ 200-300bps operating improvement (thanks to volume leverage, portfolio rationalization, product innovation) is better than the prior 5 year plan.

§ EPS growth CAGR of 8-11% (unchanged): contributing to EPS growth are: 3-5% from organic growth, 1-3% from M&A, 2-3% from margin expansion and finally 0-2% from tax & other

§ ROIC of 20% (unchanged)

§ $60-80B in cash for capital deployment: 30% towards growth investments, 30% for dividends, 40% for M&A and share buybacks

§ The company wants to target acquisitions in the health care and industrial segments

The management team initiated its 2019 guidance:

§ 2-4% organic growth, from volume & price

§ Raw materials and interest expenses will be a headwind

§ $2-4B share buyback

§ EPS growth of 7-11%, driven by price increases

§ ROIC of 22-25%

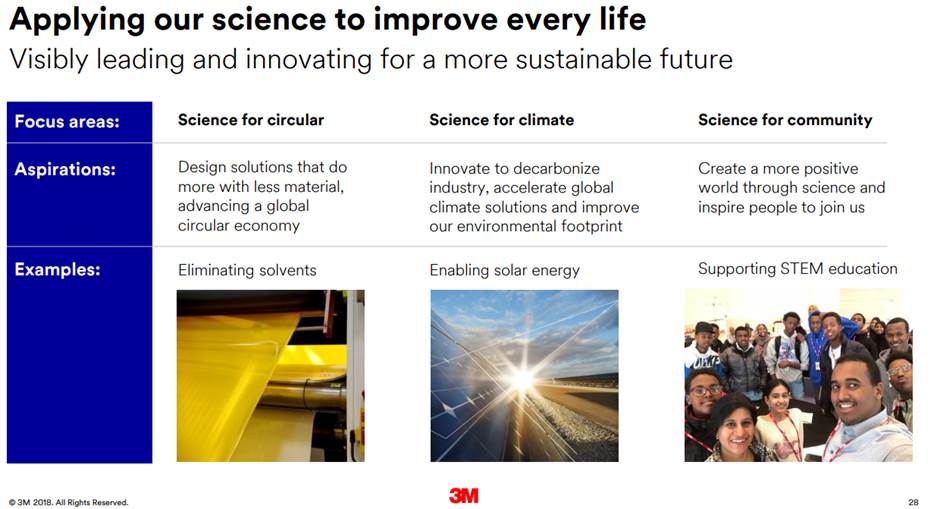

Some ESG comments were presented by the new CEO, and highlight a focus on environmental and social goals:

[tag MMM] $MMM.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109