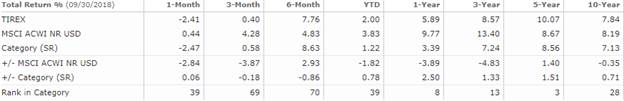

TIREX – Q3 2018 Commentary

The TIAA CREF Real Estate Securities Fund had modest gains during the third quarter, slightly underperforming its benchmark. The strategy continues to avoid sectors that are historically sensitive to higher interest rates and has benefited from allocations to sectors driven by economic growth including apartments and data centers.The fund is focused on high-quality companies with strong growth profiles, good balance sheets, and superior assets in the strongest metro areas.

Market Overview:

– REITs produced a modest gain during the third quarter after a strong second quarter

o Nine of the benchmark’s twelve sectors posted low single digit gains while self-storage and timber delivered double digit losses

– In a quarter marked by rising interest rates, REITs with pricing power fared best

o This included apartments who have ability to take advantage of economic strength

– Through the third quarter, REITs lag the broad equity index with concerns over the impact of increasing interest rates and an aging real estate cycle

Performance Overview:

– The fund posted a modest gain that marginally lagged its benchmark

– Stock selection as well as strategic underweights contributed most to performance

o Fund benefited from underweights in the self storage space as Public Storage fell due to development deliveries from competitors

– Positive contributions from Equity Lifestyle Properties, Inc. and Sun Communities

o Both companies got a lift form robust earnings

– An overweight to self-storage REIT National Storage Affiliates detracted

o Despite strong earnings, the name was not immune to sell-off in self storage space

– Second largest detractor was GDS Holdings, Inc., a provider of data center infrastructure and services in China

o GDS lagged against a backdrop of U.S.-China trade tensions and claims from a short-seller’s report that have since proven to be unfounded

Market Outlook:

– The fund remains focused on high-quality companies with strong growth profiles, good balance sheets, superior assets in the strongest metro areas

– The team currently favors single-family homes, industrials and data centers

o Continue to avoid historically high interest-rate-sensitive sectors such as health care

– The fund took profits from its holdings in the retail sector and strategically reallocated the proceeds across a number of areas

o This included manufactured homes, apartments, and data centers

– Remain constructive on the overall state of the U.S. commercial real estate and believe the country’s solid economic footing and limited new construction bodes well for continued modest growth

– Additionally, with REITs underperforming over the last few years, the asset class is currently trading below net asset value

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109