WATFX – Q3 2018 Commentary

The Western Asset Core Bond Fund outperformed the Agg during the quarter, supported by its allocation to investment grade credit and a small allocation to dollar-denominated EM debt. The team believes that the Fed does not have a set plan for rate hikes and could adjust going forward based on economic growth and inflation numbers.

Market Overview:

– The overall U.S. bond market was flat during the third quarter and the spread sectors generally outperformed equal duration Treasuries

– The yield curve flattened during the period, as short-term yields rose more than longer term counterparts

– Second quarter GDP annualized growth was 4.2%

o This represented the strongest pace since 2014

– The acceleration in GDP growth reflected positive contributions from personal consumption expenditures, exports, federal government spending and local government spending

– Labor market continued to support the economy during the third quarter

o Unemployment rate was unchanged in July and August and fell to 3.7% in September

o This marked the lowest rate since 1969

– The manufacturing sector continued to expand and support the economy during the third quarter

– Data in the housing market were mixed during the quarter

o Existing home sales were unchanged and average home price increased

– The Fed raised rates 0.25% at its meeting in September

o This pushed the Fed’s target rate to a range between 2.0-2.25%

– Both short and long term Treasury yields moved higher during the quarter

– The overall taxable bond market returned 0.02% during the quarter

o Higher yielding spread sectors generated stronger returns during the period

Performance Overview:

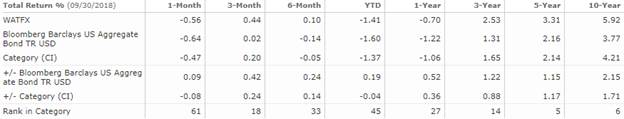

– WATFX outperformed its benchmark during the quarter

– The fund’s allocation to investment grade dollar-denominated emerging market debt was largest contributor

– An overweight to investment grade corporate bonds was beneficial as their spreads narrowed

o Individual bonds that added the most value were Goldman Sachs, BofA, and Citigroup

– Over weights to CMBS and NAMBS were additive to returns as their spreads narrowed

– Yield curve positioning detracted from performance as the short curve flattened whereas the intermediate curve steepened over the period

– Reduced the fund’s allocation to bank loans and modestly pared its CMBS exposure

o Also reduced allocation to student loan asset-backed securities as their spreads tightened

– In terms of duration, maintained over weights at the 30-year and 2-year segments on the yield curve

o Added to the overweight of the 2-year portion of the curve, but slightly trimmed the 30-year overweight

Market Outlook:

– Fed officials took another step in normalization process by dropping long-standing language saying that “the stance of monetary policy remains accommodative”

o Powell said that a “wait and see” approach may be more appropriate as long as inflation expectations remain well anchored

– In the U.S. the economic picture has been better than what was anticipated

o Above trend growth, subdued inflation and a cautious Fed remain their base case

– Growth may come in between 2.5-3% for the second half of the year

o Sluggish pace of inflation will likely continue in U.S. and abroad

– Outlook for a broad and sustained global recover has been challenged on a wide variety of fronts

o They believe that global growth has subdued to a moderate level of 3.5-4.0% but do acknowledge that risks remain

– They have always characterized the global recovery as a two steps forward-one step back process

o They believe that the emerging market setback is just one of these steps back but remain optimistic in their forward view

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109