TORIX – Q3 2018 Commentary

The Tortoise MLP & Pipeline Fund had positive returns during the third quarter following a very strong second quarter. The team believes that energy fundamentals are outstanding following expectations that U.S. production growth for crude oil and natural gas will continue over the next five years.

Market Overview:

– Broad energy moved slightly higher during the third quarter after a strong double digit return second quarter

o Commodity prices ended the period little changed

– Midstream energy fundamentals remained strong with many companies beating earnings estimates raising guidance and announcing new pipeline projects

o Midstream investor sentiment remains mixed due to continued structural changes and regulatory hurdles offsetting a positive fundamental environment

– The midstream sector moved higher during the third quarter with pipeline companies returning 1.1% and MLPs returning 5.2%

o Regulatory announcements and structural changes balanced strong fundamentals

– MLPs continue to simplify their structure through consolidation and/or elimination of IDRs

o One effect of these efforts is a lower cost of capital and more retained cash flow

Performance Overview:

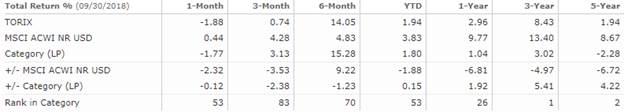

– TORIX returned 74 bps during the third quarter and is up nearly 3% over the past year

– The top contributors during the quarter were Targa Resources and Cheniere Energy

o Targa’s performance was driven by Permian basin wet gas volume growth

o Cheniere performance was driven by a final investment decision for additional liquefied natural gas train

– The top detractors during the period were Enbridge Inc. and SemGroup Corp.

o Enbridge lagged due to a questionable source of funding due to high leverage and a robust project backlog

o SemGroup lagged due to concerns regarding drilling regulations in Colorado

Market Outlook:

– In the team’s view, energy fundamentals are outstanding following expectations that U.S. production growth for crude and gas will continue over the next five years

o For midstream companies transporting energy commodities, this should result in greater cash flow

– As U.S. production grows, new infrastructure projects are needed to transport greater volumes

– The team’s outlook for capital investments remains at approximately $129 billion for 2018 – 2020

o This includes MLPs, pipelines, and related organic projects

– These projects are critical to relieve takeaway capacity constraints, particularly from the Permian basin where additional infrastructure is need to reach full production potential and in natural gas liquids segment

– Much of the incremental production growth will be exported, driving a need for more export infrastructure, representing another opportunity for U.S. midstream operators

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109