LISIX – Q4 2018 Commentary

Along with nearly all global equity markets in Q4, international developed sold off significantly. During the period, the Lazard Strategic International Equity portfolio did outperform its EAFE benchmark, which is to be expected in periods of extreme volatility. The team is monitoring geopolitical concerns in Europe and Asia but believes that softening policy in the U.S. and the start of Chinese stimulus should help global equity markets.

Market Overview:

– International equities fell sharply in the fourth quarter

o Driven by tighter U.S. monetary policy, slowing global growth, collapsing oil prices, continued trade tensions

– Most defensive sectors held up best during the volatility

o Led by utilities, telecoms, health care, and consumer staples

– Weakest sectors were the most cyclical

o Energy, industrial, consumer discretionary and financials

o Tech was also hurt by cyclical fears

Performance Overview:

– LISIX outperformed the MSCI EAFE index during the quarter

o In the materials sector, Rio Tinto’s solid balance sheet and strong cash flows supported the stock

o Defensive professional publishers Relx and Wolters Kluwer also held up well

o Japanese discounter Don Quixote rose after a significant transaction with convenience store operator FamilyMart

– On the negative side, the portfolio’s energy holdings were perceived as geared to the falling oil price, and on a relative basis performance was hurt by lower exposure to utilities

o In the industrials sector, equipment renter Ashtead and building materials supplier Saint Gobain fell on cyclical concerns

o Power tools maker Makita saw weakness in margins

o Canadian industrial Bombadier fell sharply after downgrading its cash flow guidance

Market Outlook:

– On the macro side, China continued to slow as tighter credit policies were exacerbated by trade war fears

– Europe also slowed due to volatile domestic politics and the lingering effects of an auto regulatory change

– First cracks appeared in U.S. economic data despite continued strong payroll figures

o Rising rates and cooling global growth started to have an effect

– Tightening liquidity started to impact credit markets with spreads expanding rapidly through the quarter

o This was a particular concern given the overwhelming amount of debt that has continued to pile up on public and private sector balance sheets since the financial crisis

– However, we are already starting to see policy soften in the U.S. alongside first signs of stimulus in China

o Many cyclical stocks have fallen to intriguing valuations absent a full blown recession

– The portfolio team remains confident that by continuing to focus on stocks with sustainably high or improving returns the long term track record should continue

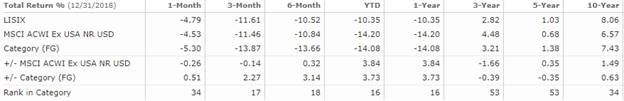

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109