HLMEX – Q4 2018 Commentary

Emerging market equities sold off during the fourth quarter but actually outpaced developed markets on a relative basis. The Harding Loevner Emerging Markets Equity fund underperformed its benchmark for the year driven mostly by sector selection as they faced a significant style headwind. Harding sees long term opportunity in EM, however, as there are new growth opportunities with companies that have taken advantage of research and technology to become multinational and less dependent on their domestic economies.

Market Overview:

– Emerging market stocks fell in the quarter amid fears that a global economic slowdown looms

o Due to continued monetary tightening and the effects of a protracted trade war between the U.S. and China

– EM did outperform developed markets during the quarter but Ems lost 14% for the full year

– The U.S. Federal Reserve declared in October that it planned more hikes

o In December it delivered its ninth quarter point rise

o Long term Treasury yields fell flattening the yield curve

o Along with widening credit spreads in global markets suggested investors saw and end to the economic expansion

– Developments in the U.S. – China trade war did not assuage recessionary fears

o In October, Mike Pence made clear that the objective is not just reducing trade imbalance but also reducing the economic and military threat China poses to the U.S.

o A protracted trade war threatens the possibility of disruption to global supply chains, and discourages company managements from making fixed capital investments

– China’s economy showed new signs of weakness

o Measures of economic activity and business confidence deteriorated with PMI turning negative

o Chinese monetary policy became more accommodative, officially moving to “neutral” to “tightening” with bank reserve requirements lowered

Performance Overview:

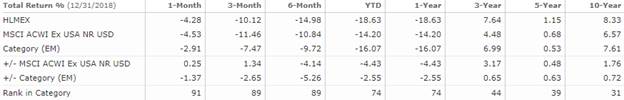

– The Harding Loevner EM strategy fell 9.7% in the quarter while the MSCI EM Index dropped 7.4%

– Stock picking impact during the quarter was negative especially in industrials, consumer staples, and energy

– Impact was partially offset by gains in financials

– Stock selection in China, South Africa, and Mexico was particularly weak

o Underweight in India and overweight in Mexico also hurt

– For the calendar year, the strategy faced a significant style headwind as the fastest-growing stocks significantly underperformed the broad index

o Under the growth ranking methodology, prices of stocks in the fastest growing quintiles fell 26% while those in slowest growing quintile fell only 7%

– In 2018, the portfolio underperformed its benchmark

o The lag began after mid-year and was driven mostly by banks

Market Outlook:

– Historically the growth of EM companies has been linked to their local economies

o As they develop, the countries see increasing consumption of diverse goods and services as household incomes rise

o Recently new types of growth companies have emerged; they have the ability to be multi-national due to capabilities in research and technology

– The team is attracted to EM banks based on industry’s favorable characteristics:

o Household penetration of financial services is typically low in EM economies

o As income levels rise, the demand for these services accelerates

– Smartphone component manufacturers represent the newer breed of EM companies whose growth opportunities stem from their potential to be strong multinational competitors in their industries

o The challenges such businesses face are global in nature driven by global industry factors rather than domestic developments

– The team’s goal remains to find companies that can grow and analysis is focused on how likely a company is to sustain its growth

o This is done through competitive advantages within its industry, skillful management and financial strength

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109