TIREX – Q4 2018 Commentary

The real estate sector sold off during the fourth quarter, but actually gained substantial ground relative to the S&P 500 for the year. The TIAA CREF Real Estate fund slightly was also down for the quarter but slightly outperformed the FTSE Nareit All Equity REIT Index. The team remains focused on long term growth oriented REITs and believes that, following an extended period of underperformance, valuations in real estate are very attractive.

Market Overview:

– The fourth quarter marked a disappointing conclusion to 2018 for U.S. equities

– Most U.S. equity indexes finished the year with double-digit declines

o Despite also pulling back for the quarter, REITs managed to limit their losses to mid-single digits

o REITs were helped by their defensive nature in a risk-off environment

– REITs posted a total return of -6.5% during the quarter compared to the S&P 500 that was down 13.5%

o The REIT market was able to close its underperformance gap for the year

– Healthcare, self-storage, and triple net lease delivered the best return during the quarter

o Hotel and office REITs fared the worst

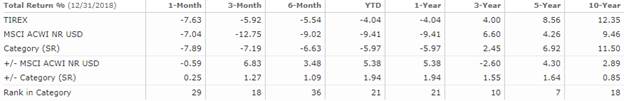

Performance Overview:

– The fund beat its benchmark during a period in which REITs outperformed the broader U.S. equity market

o The fourth quarter’s risk-off environment infrastructure and health care, both of which outperformed during the period

– Stock selection as well as some strategic underweight allocations contributed most to the fund’s fourth quarter performance

– Two of the top individual contributors were REITs in the manufactured housing sector

o Equity Lifestyle Properties and Equity Lifestyle both benefitted from investors favoring relative steadiness of the manufactured housing business

– Fund was also helped by an overweight in free standing retail REIT Agree Realty Corporation

– An underweight to American Tower detracted the most from performance

o More defensive names within REITs outperformed during the quarter

– The second largest detractor was GDS Holdings, Inc.

o Provider of data center infrastructure and services in China, it was hit hard for the second straight quarter by U.S.-China trade tensions

Market Outlook:

– The focus remained on long-term, growth-oriented REITs with superior balance sheets, such as single-family homes, industrials and data centers

– The fund continues to strategically take profits and reallocate the proceeds across a number of sectors

o This includes infrastructure and manufactured housing

– The team remains constructive on the overall strength of U.S. commercial real estate and believe the country’s solid economic footing

– With the weak performance of U.S. REITs over the past few years the sector is currently trading at the largest decrease to net asset value since the financial crisis

– The selloff in retail REITs has actually presented buying opportunities

– Real estate should benefit on a relative basis from the recent uptick in inflation, and companies have the ability to raise rents to mirror rising yields

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109