Current Price: $133 Price Target: $160

Position Size: 3.8% TTM Performance: 8%

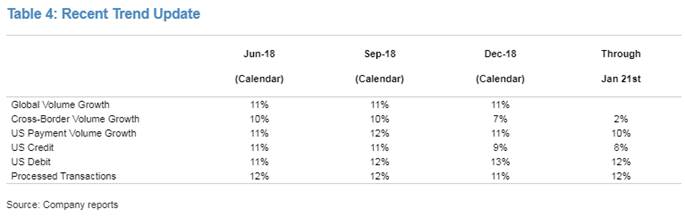

Visa continued to perform well in the first quarter with better than expected revenue and EPS. Visa continued double-digit growth in payments volume and processed transactions. Net Revenues were up 13% aided by lower client incentives and EPS was up 21%. Guidance on 2Q revenue was lowered because they are seeing some weakening macro trends in cross border which they attribute to geopolitical factors and a stronger dollar. They’re maintaining full year guidance (low double digit top line growth and mid-teens EPS growth) for now. They feel we may have more clarity on the issues impacting cross border transaction over the next few months…specifically they talked about, “economic uncertainty related to the US government shut down, Brexit, big equity market swings, and the trade dispute with China,” saying they “are starting to have an impact on consumer sentiment.” Cross border accounts for ~27% of gross revenue and is higher yield. There is no evidence in domestic volumes of broader economic weakness. US credit trends did weaken in the second half of December, but they rebounded in January. Credit trends tend to be more macro sensitive than debit.

Key Takeaways:

· They had 50 billion transactions on their network driving $2.9 trillion in total volume.

· Payment volume was up 11% on a constant dollar basis. U.S. payment volume up 11% and Europe up 9%.

· Credit was up 9% and debit was up 13%. U.S. debit and credit increased 13% and 9%, respectively. Like last quarter, debit growth (which skews younger and lower income) continues to be stronger than credit growth.

· So far through January 21, U.S. payments volume growth was 10%, with U.S. credit growing 8% and debit, 12%

· This saw strong holiday spending in line with last year. Retail growth was fueled mostly by e-commerce which grew 3x the rest of retail.

· Deterioration in cross-border trends and in US credit spending emerged in the second half of December. Cross border was up 7%, but that was a deceleration of 300bps sequentially. US credit trends rebounded in January, but cross-border has remained weak.

· In the US, in-bound commerce rate is now negative. As the dollar strengthened in mid-2018 this slowed and it has continued to slow. In-bound commerce from Canada, Latin America, China, Australia and Europe has been particularly soft. Stronger dollar drove robust outbound Commerce from the US.

· Every 100bps change in cross-border revenue equates to ~$0.02 in annual EPS all else equal.

Updates on growth initiatives…

· Contactless ortap-to-pay payment penetration continues to rise globally – this is in very early stages in the US.

o Contactless is not just paying with a phone, it means paying with a card enabled w/ near field technology. So you just wave the card in front of the reader.

o Rising penetration of contactless cards should be a tailwind to volume growth because it tends to capture a greater portion of smaller transactions.

o Excluding the US, 44% (up from 40% in prior qtr.) are now contactless. Australia is most penetrated at 90% of face-to-face transactions.

o Very few cards in the US have this – they expect 100 million enabled cards by the end of 2019. Wells Fargo and Bank of America will start issuing tap-to-pay cards this year. Target enabled contactless this month, and Hy-Vee, a large grocer in the Midwest, also enabled tap-to-pay.

· Visa Direct– key way they are capturing incremental payment flows. Again grew 100%+

o Visa Direct is real time payment technology that allows Visa to participate in different types of transactions like bill pay, P2P (e.g. Venmo), instant paycheck (e.g. Postmates instantly paying their delivery workers), B2B transactions, insurance payments, healthcare reimbursement, etc. Things that were previously accomplished through check, ACH or cash.

o For the US, this is a $10 trillion opportunity: $1 trillion in P2P and $9 trillion in business disbursements

Valuation:

· Adjusted free cash flow of $3.1 billion for the first quarter. Trading at a 4.6% FCF yield.

· Returned $3B to shareholders in the quarter.

Thesis:

· Visa is the number one credit and debit network worldwide – accounting for about half of all credit and roughly three fourths of all debit card transactions.

· We are still in the earlier innings of the digitization of electronic payments. This is a secular tailwind supporting Visa’s growth as 1.) Electronic payments continue to replace cash 2.) Commerce moves online 3.) Consumer spending grows globally

· Visa’s asset light “toll both” business model is characterized by recurring revenues, high incremental margins, low capital expenditures, and high free cash flow.

· Visa’s recent acquisition of Visa Europe should be a nice tailwind over the next few years as the European market is in the earlier stages of electronic payment adoption and Visa is well positioned to gain market share and improve margins in the region.

$V.US

[tag V]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!