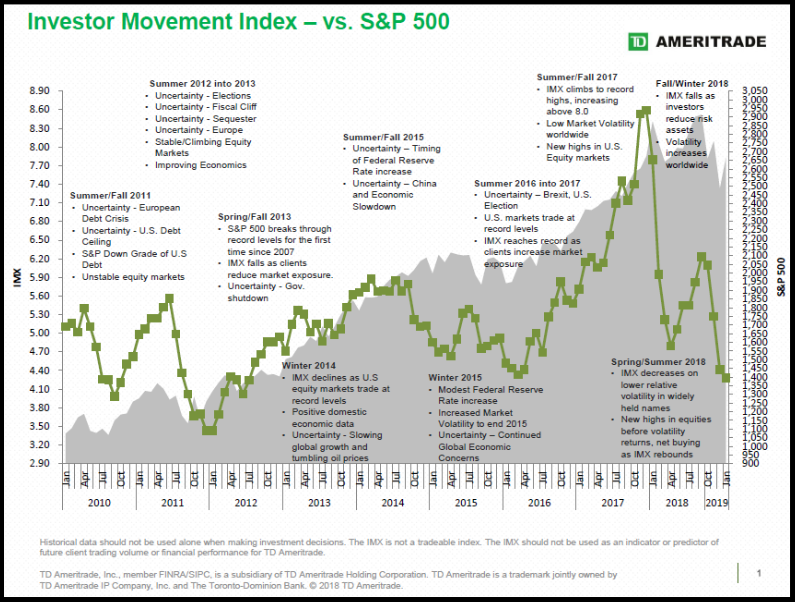

Below is a graphic from TD Ameritrade that looks at retail client allocation changes within the S&P 500. What the green line shows is that individual investors sold out of the S&P 500, choosing to buy on less risky asset classes like core bonds.

This is just another reminder that attempting to time the market is very difficult. As we discussed this morning, tempering client fears makes it easier to keep individuals invested in the market. The turnaround between December and January is an example where one could have recouped much of their loss in a relatively short timeframe.

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109