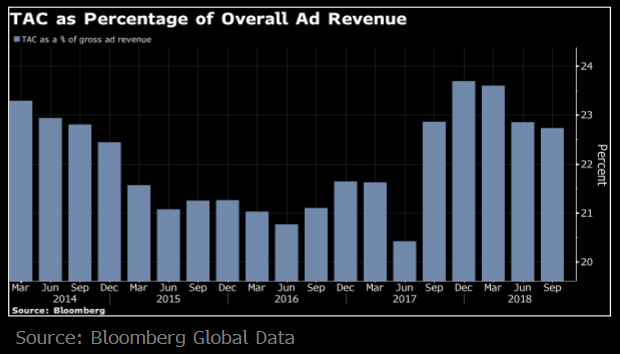

Alphabet reported mixed Q4 results, beating on top line (+22%) but spending on cloud and YouTube resulted in lower than expected profit margins (21% vs 22% expected). Two key positives were better than expected: ad revenue and lower TAC. Ad revenue disappointed last quarter, so this was an important reversal. TAC is the largest cost of revenues and, after climbing for a while, continues to trend down. Weaker operating margins were from higher R&D, headcount and marketing. Headcount increased to 99K people from 80k a year ago. The most sizable head count increases were in cloud for both technical and sales roles. The higher spending is not totally unexpected. This quarter follows a similar trend of rising expenses and higher capex impacting profitability as they “invest ahead of growth,” particularly, cloud, YouTube and hardware. “With great opportunities ahead, we continue to make focused investments in the talent and infrastructure needed to bring exceptional products and experiences to our users, advertisers and partners around the globe."

Key Takeaways:

· They are seeing broad based strength globally with the US growing 21%, EMEA up 20% and APAC up 32%.

· Net advertising revenues were up 21% to $25.2B vs consensus of $24.7B. Mobile search and YouTube continue to drive ad revenue.

· Revenue from Google sites was up 22%. Network sites revenues were up 12%. Other revenues (includes Google Play, Google Cloud, and Hardware) were up 31%.

· TAC was slightly better YoY at 23% percent of revenue. High TAC levels have been driven by the mix shift to mobile and to programmatic.

· Margins were negatively impacted by higher “other cost of revenues.” This is everything other than TAC. Key drivers were content acquisition costs (CAC) for YouTube, costs associated with data centers, and hardware-related costs for Made by Google and the Nest family of products.

· OpEx of $13.2B was up 27% YoY (vs. consensus of +23% YoY) driven by increases in R&D, headcount and marketing.

· “Other Bets” also contributed to the operating profit miss. Operating loss for the segment was $3.4B for the FY18, vs a loss of $2.7B in 2017. Accrual of compensation expenses to reflect increases in the valuation of equity in certain Other Bets hurt margins.

· Capex continues to increase. They spent nearly $7 billion in capex in 2018.

· Google Cloud: New head of cloud announced, Thomas Kurian. Management is not giving any specific cloud metrics, though they did say they more than doubled both the number of Google Cloud Platform deals >$1M as well as the number of multi-year contracts signed.

Valuation:

· FCF for 2019 is expected to be ~$31B or about a 4% FCF yield.

· $105B in net cash, 13% of their market cap.

Thesis on Alphabet:

· Online advertising as a share of overall Ad budgets will continue to grow as:

o People spend more time on the internet/mobile internet vs tv, radio, newspapers etc

o Higher ROI (+ easier to measure) per marketing dollar spent online vs other ad mediums

· They are the global leader in search.

· Well positioned to benefit from increased smartphone penetration.

· Flexible business model provides operating leverage with high returns ROIC and huge free cash flow generation.

$GOOGL.US

[tag GOOGL]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!