TCPNX – Q4 2018 Commentary

The Touchstone Impact Bond Fund fell short of its benchmark in the fourth quarter but outperformed for the year as a whole. Touchstone maintains a quality diversified portfolio that remains agnostic to the yield curve. The team believes that its current positioning in Treasuries and MBS should benefit from the divergent Fed monetary policy and global trade disputes as demand from foreign investors has decreased.

Market Overview:

– Spread sectors underperformed in the fourth quarter

o Events that created unease earlier in the year became bigger concerns

o Worries about an extended trade war with China

– Monetary policies that drove up short term rates became viewed as overly aggressive

o Concerns surfaced that the U.S. Fed would cause inversion in yield curve

o While an inverted yield curve is usually a leading indicator of recession some worry that a policy error by the Fed could cause the yield curve to invert and actually cause a recession

– This backdrop created a demand for safe haven assets pushing U.S. Treasury prices higher and yields lower

– U.S. Treasury securities and higher quality securities were best performing fixed income sectors

– In general, performance was weak among spread products, specifically in corporate bonds

– Several high profile companies exhibited weakness which impacted the entire corporate bond market

o High degree of leverage throughout the market took center stage

– Throughout the recent economic cycle, the amount of BBB-rated corporate debt has surged

Performance Overview:

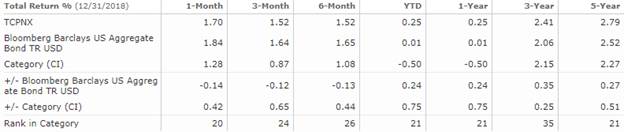

– TCPNX underperformed its benchmark during the fourth quarter but was up for the year

– Market trends and the macro environment created headwinds for spread sectors

o The fund’s overweight position in this area led to relative underperformance

– Fund’s selection within U.S. Agencies was the primary contributor to performance during the period

o Overweight to utilities and underweight to economically sensitive sectors detracted

– Fund’s effective duration matched the benchmark

o Detracted slightly during the period but over time interest rate risk and performance will be effectively equal to that of the benchmark over time

Market Outlook:

– The team believes that many events and developments are taking place that could provide opportunities for the fund

– The Fed’s normalization of its balance sheet could provide a tailwind for the fund

o Portfolio is underweight both Treasuries and single family MBS

– Pace of the Fed’s balance sheet has been modest at approximately $150 billion

o Run rate is scheduled to meet upwards of $50 billion per month by end of 2019

– The divergent monetary policy of the U.S. have increased currency hedging costs

o This along with trade disputes has reduced demand for U.S. Treasuries from foreign buyers

o Going forward these two large sources of demand could pull back allowing the fund to gain from its exposure to Treasuries and Single Family MBS

– Unexpected volatility within the financial markets could be fueled by increased levels of leverage and trade rhetoric

– Believe the fund’s emphasis on less economically sensitive sectors and high quality could act to mitigate these impacts

o The fund is positioned well and maintains a discipline that balances risk and return objectives

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109