TORIX – Q4 2018 Commentary

The broad energy sector was down nearly 24% during the fourth quarter and midstream pipelines were down almost 14%. The Tortoise MLP & Pipeline Fund ended the year down 15% due to decreasing oil prices, uncertainty around OPEC meetings, and unknown short term implications of getting rid of IDRs. As we have seen to start the year, MLPs have started to come back as oil prices have crept higher and investors see the space as a yield play with strong fundamentals over the long term.

Market Overview:

– The broader energy sector retreated substantially during Q4 returning -23.7%

o This brought broad energy returns to -18.1% for the year

– Continued U.S. production growth, increased production from OPEC and uncertainty leading to December 5th OPEC meeting drove oil prices lower

– Midstream segment pulled back partly due to near term uncertainty around simplification transactions and further evolution of the midstream segment

– Despite market turmoil, midstream companies showed resilience with nearly 95% of midstream MLPs increasing or maintaining distribution over prior quarter

– Outlook for capital investment remains at approximately $139 billion for 2018 to 2020 in MLPs

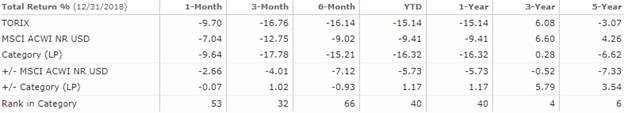

Performance Overview:

– Midstream energy returned -13.6% for the fourth quarter and -10.5% for the year

o MLPs retuned -13.4% for the year

– TORIX was down 16.76% during the quarter and lost 15.14% for the year

– Top contributors during the quarter were Tallgrass Energy and Valero Energy Partners

o Tallgrass is a midstream natural gas company that was benefited by the completion of simplification transaction

o Valero is a midstream refined product pipeline that was benefited because it was acquired by parent company Valero Energy

– Top detractors were Targa Resources Corp. and ONEOK, Inc.

o Targa is a midstream crude company whose commodity based contracts were negatively impacted by weaker commodity prices

o ONEOK is a midstream natural gas company that was hurt because relative underperformance followed recent outsized performance

Market Outlook:

– The MLP sector continues to evolve as they expect higher distribution coverage and lower leverage going forward

o Many companies have shifted to self-funding the equity portion of the capex programs reducing reliance on capital markets access

o Expect dramatically less equity supply issuance in 2019 and beyond as companies focus on return of capital to shareholders

– Focus is now on strong yield, debt pay-down, distribution growth and share buybacks

– Have deemed 2018 the year of the transaction, with more than half of MLP companies participating in simplification transactions

o In many cases this resulted in elimination of incentive distribution rights (IDRs)

– These transactions benefited the sector, resulting in improved corporate governance and lower costs of capital

o Expect trend to continue and by the end of 2019 anticipate more than 85% of MLPs will eliminate IDRs

– With significant midstream investment needed to transport the record U.S. energy supply several pipeline companies are planning to consolidate efforts to efficiently put capital to work

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109