Key Takeaways:

Current Price: $49 Price Target: $61

Position Size: 2.13% 1-year Performance: -10%

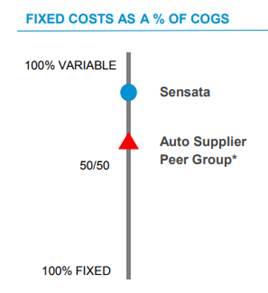

Sensata reported slower revenue growth sequentially, a miss vs. consensus as well. Organic sales growth was +3.5%, with an overall Chinese business organic growth rate of 4.3%, which we think is respectable given the recent business volatility cited by the company and peers. Although the Chinese auto production end market declined 15% in 4Q (way beyond their expectations) and drove most of the slowdown in their overall results in 4Q18, Sensata had an impressive +1560bps sales above the auto end market production. The company noticed a small slowdown in Europe as well, but a strong North America growth. For 2019, management expects +400-500bps relative outperformance over the global auto production. While China’s economy is still growing, volatility is expected to continue in 1Q19. Regarding its other end markets, aerospace was strong but industrial weak driven by the Chinese slowdown. Margins expanded 80 bps in the quarter despite lower volume and unfavorable impacts from tariffs. Their business model enables continued profitability, even in down cycles, as they have a highly variable cost structure. While today’s results were below expectations, investors were expecting much worse. It is reassuring to see the company able to protect its operating margins in a volatile environment, a proof of the company’s strong business model.

2019 guidance:

Organic revenue +2-5%, with market assumptions:

· Global auto market -1% to -2%

· China auto -3% to -4%

· Global HVOR market -1% to -2%

· 1Q19 order fill rate of 91%

Adjusted EPS +7-10%

$0.16/share benefit from new $250M share repurchase program

FCF $510-550M

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

$ST.US

[tag ST]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109