DBLTX – Q4 2018 Commentary

As volatility spiked in 2018, investors moved away from risk assets and the Barclays Agg was flat for the year. The DoubleLine Total Return Bond Fund outperformed its benchmark during the fourth quarter and added 174 bps of outperformance for the full year. Given the current state of local and global fixed income markets, DoubleLine favors actively managed products that are well diversified and biased toward quality holdings.

Market Overview:

– Market volatility picked up in 2018 as global central banks became less accommodative via rate hikes and balance sheet reduction

– The S&P 500 moved 2% or more 20 times, marking the highest number since 2011

– Throughout the year global growth became less synchronized as U.S. equity markets outpaced both developed and emerging markets despite all being down

– On December 19, the Fed announced its decision to raise rates by 25 bps to 2.25 – 2.5%

o Powell referred to its tightening policy as being on autopilot

– UST rallied following the Fed chair’s comments as 10-year yields fell 13 bps heading into yearend

– The FOMC dot plot schedule was lowered from 3 to 2 hikes for 2019

Performance Overview:

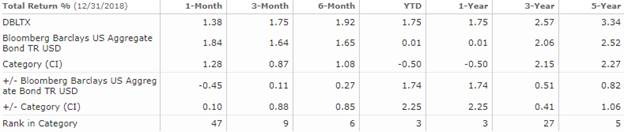

– In the fourth quarter, DBLTX outperformed the Agg returning 1.64%

– Over the full year, the fund outperformed the benchmark by 174 bps mostly due it MBS positioning

– Outperformance was largely driven by Agency RMBS

o Fixed rate CMOs benefited from the rate rally

– 2-year and 10-year U.S. Treasury yield were down 33 bps and 38 bps respectively

– Despite spread headwinds across securitized debt, all non-Agecny sectors were accretive to performance for the period

o This was due to interest income

– Asset-backed securities and subprime non-Agecny RMBS outperformed as prices increased during the period

Market Outlook:

– The factors that drove risk assets for much of 2018 are likely to continue to do so in 2019

o These include the price of oil, a China trade deal, and the Fed’s path towards policy normalization

– They believe that UST yields will continue to rise due to increased UST rupply as a result of quantitative tightening in the US, large current US deficit, and the reduction of global quantitative easing

– Given increased volatility and late stage global economy, they continue to favor fixed income portfolios that are well diversified

o Believe that actively managed products with a bias toward higher credit quality with attractive yield per unit of duration make most sense in current environment

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109