Key Takeaways:

Current Price: $42.5 Price Target: $51

Position Size: 1.65% 1-year Performance: +7%

Sanofi reported 4Q18 sales results containing no surprises, with sales up 3.9% and EPS +4.7%. Flu vaccines was a growth driver this past quarter, while the diabetes franchise remained weak. The divestiture of Zentiva, its European generic business as well as growth of Dupixent will boost margins going forward. The Dupixent sales increased thanks to advertising and the recent US launch in asthma (the drug is approved for severe form of eczema and asthma). Sanofi new R&D chief is pruning the portfolio to focus on better prospects, accelerating research on 17 programs while discontinuing 25 others. The firm is putting cancer treatment on its priority list, and removing diabetes from it, which had been a major growth driver for the company in the past (with drug Lantus). In addition, the company is refocusing its segments in order to “unlock organizational efficiencies”… we have heard that from other companies in the past, and we remain unconvinced about the value of such reorganizational efforts. But on the positive side, Sanofi’s dividend yield is now an attractive 4.2%, which offers good support to the stock.

2019 initial guidance:

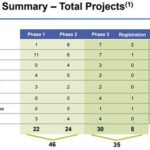

R&D: focus back on Sanofi’s pipeline in specialty medicines and vaccines

No cost cutting plan announced but R&D should remain flat y/y

3-5% EPS growth (ex-FX)

FX to be 1-2% positive to EPS

Thesis on SNY:

- Sanofi is approaching the end of its patent cliff, and is well position to grow earnings

- ROIC and ROE are likely to improve from current levels

- Underappreciated pipeline, with eighteen new product launches expected over the next four years

- Attractive dividend yield, valuation and capital allocation

$SNY.US

[tag SNY]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109