So far, 66% of the companies in the S&P 500 have reported results for Q4.

· Overall, companies are beating estimates, but the magnitude of beats is lower than what’s typical. Also, revenue and EPS growth estimates are coming down. EPS growth for Q1 is expected to be slightly negative.

· 71% have beat on EPS (= to 5 yr. average) and 62% have beat on revenue (above 5 yr. average).

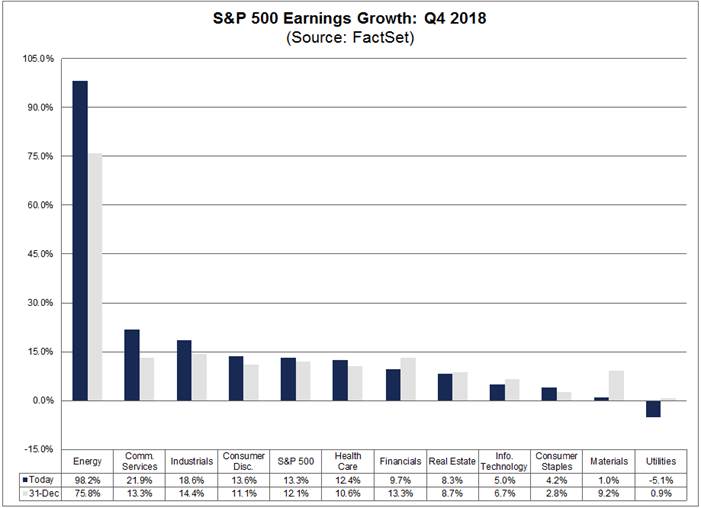

· The blended sales and blended earnings growth rates for Q4 is 7% and 13% respectively. 10 of the 11 sectors are reporting YoY earnings growth.

· More companies are issuing negative EPS guidance for Q1 than average. Not all companies issue guidance, but of the 65 in the S&P that have so far, 82% issued negative guidance.

· Growth is expected to decelerate next year to 5.1% revenue growth and 5% earnings growth. Currency headwinds are a factor in this.

· The forward 12-month P/E ratio is 15.8.

· The Consumer Discretionary sector has the highest forward P/E ratio at 19.6x, while Financials has the lowest at 11.3x.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109