On 1/22/19, Travelers reported Q4 EPS of $2.13, slightly above consensus of $2.10. Catastrophic losses were elevated due to the devastating Camp Fire and Hurricane Michael. Excluding these losses, Traveler’s results improved year-over-year with the combined ratio falling 130bps to 91.1%. Travelers is a high quality, disciplined underwriter of insurance that is focused on returning capital to shareholders. TRV is selling at an attractive valuation of 11.4 x 2019 earnings.

Current Price: $127.16 Price Target: $145 (raised from $125)

Position Size: 2.19% TTM Performance: -5.8%

Thesis Intact. Key takeaways from the quarter:

- Results were solid considering catastrophic losses

- Solid premium growth 4% and retention rates of 87%

- Investment income +15% with help from rising rates and lower taxes

- Slight decrease in combined ratio to 91.1% due to improved results in autos and bond and specialty segments

- 2018 ROE 10.7% up 170bps from 2017

- TRV continues to aggressively return capital to shareholders – for 2018 TRV returned $2.1b to shareholders out of $2.4b in earnings

- Over past 10 year shares outstanding have fallen 57%!

- Shareholder yield of 6.2% which is a dip from +10% of prior quarters

- Management employing capital wisely! Instead of investing in mature business with spotty pricing, they are returning excess capital to shareholders

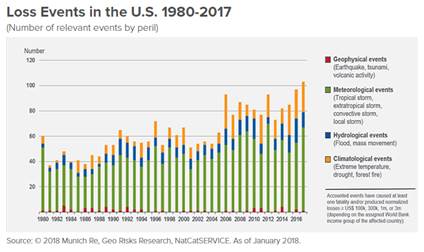

- Catastrophic losses have been elevated for past few years

Effective 2019, TRV significantly increased its catastrophe reinsurance, which should help smooth earnings and protect the balance sheet in the future.

4. Valuation is attractive. Currently TRV trades at a forward P/E of 11.4 which is close to the bottom of its five-year valuation range of 10 – 15.

The Thesis on TRV:

- We expect TRV will be able to grow book value per share in the mid-single digits over the near-medium term, and generate ROE in the 10-14% range

- Industry leader with disciplined underwriting and investment portfolio track record

- Consistent returns in the low to mid double digits

- Responsible capital allocation and proven desire to act in the best interests of shareholders

Thanks,

John

($TRV.US)

John R. Ingram CFA

Managing Director

Asset Allocation and Research

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109