Key takeaways:

Current price: $115 Price target: $123

Position size: 2.30% 1-year performance: +1.5%

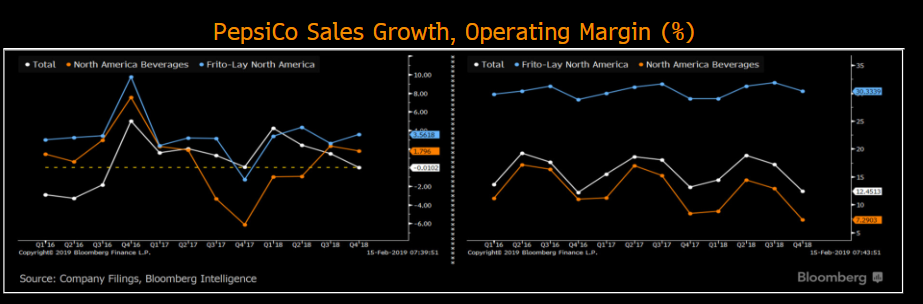

Pepsi reported +4.6% of organic revenue growth, helped by pricing +4% (although FX was -4%). What mattered today was the company’s 2019 guidance announcement. The company plans to return $8B to shareholders in 2019 through share repurchases and dividends. PEP expects organic top line to grow 4% (above consensus of +3.4%), and EPS of $5.50, which would be a 3% decline y/y as the company expects to reinvest for growth (more marketing spending) and incur some restructuring costs. It is pretty common to see an EPS “reset” lower as a new CEO takes the helm of a company. Thus there is no surprise there with a 3% decline in EPS this year. There is nothing completely different with newly appointed CEO Ramon Laguarta strategic vision. He has a desire to streamline Pepsi’s manufacturing and supply-chain footprint for better performance, becoming “leaner, more agile and less bureaucratic”. As costs rise, Pepsi is renewing its efforts to drive productivity gains and is targeting $1B in savings/year until 2023. Long term, Pepsi is hopeful to return to an algorithm of +4-6% organic growth, core operating margin expansion of 20-30bps and a high-single-digit core EPS growth starting in 2020.

[tag PEP]

$PEP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109