Key Takeaways:

Current Price: $93 Price Target: $100

Position Size: 3.14% TTM Performance: +10.8%

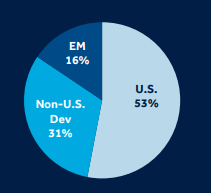

Medtronic released their 3Q FY19 results this morning, with organic revenue growth of 4.4%, a 50bps adjusted operating margin expansion and +9% EPS growth. Recent product launches and strength in emerging markets (+14%) helped revenue growth and was well diversified: 13% growth in China, 23% growth in South Asia, and 20% growth in the Middle East & Africa. Emerging markets now represent 16% of MDT’s sales base. MDT highlighted its differentiated strategy of using private and public partnerships and optimizing its distribution channel as making a real difference in terms of growth and increased penetration of existing products. And of course, rising demand is also a driver to EM growth.

The company raised its FY19 guidance numbers, although not to the extent that it would get anyone excited, mostly raising the lower end of its revenue from 5.0% to 5.25%. The free cash flow increase is more positive, seeing a 6% increase of its lower end, going from $4.7B-5.1B to $5.0-5.2B. Medtronic has entered a multi-year plan to expand its operating margin (less manufacturing footprint, centralization of back office functions for example), and convert a greater percentage of its net income to free cash flow. At this point, it seems that Medtronic can achieve its long-term target of top line growth (4%) and margin expansion (40-50bps). We are maintaining our price target at this point.

Revenue Base:

MDT Thesis:

· Stands to benefit from secular trends (1) increased utilization from Obamacare (2) developed populations age

· Strong balance sheet and cash flows. Increased access to non-cash should allow MDT to meaningfully increase their dividend

· 6% normalized Real Cash yield provides solid total return profile over next 2-3 years

· Ownership interest aligned. Management incentivized to maximize shareholder returns – 14% 10yr average ROIC

[tag MDT]

$MDT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109