Key Takeaways:

Current Price: $96.7 Price Target: $136

Position Size: 1.94% 1-year Performance: -12%

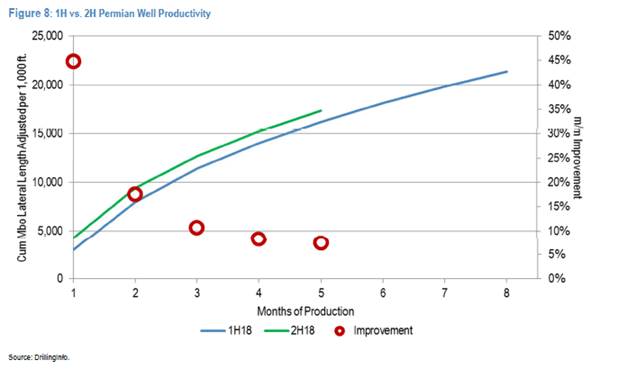

EOG reported 4Q18 EPS and EBITDA below consensus: while the US oil production beat expectations, EOG had higher unit costs and lower natural gas production. Capex was higher as well due to more efficient drilling that led to more wells being completed. Importantly, in 2H18 EOG showed improvement in its Permian performance (big driver to its growth), alleviating some concerns around this region that lingered in 1H18. The company’s premium drilling strategy started in 2015 is paying off: ROCE was 15% in 2018, way above its 10% target.

It appears that capex will be more front-end loaded in 2019, but the management team reaffirmed being committed to its capital budget (reassuring!). 2019 guidance for oil production was below consensus but that includes the international asset sales. Adjusting for the sale, the miss is only ~2%. The management team seemed confident to meet its 2019 goals thanks to good operating momentum and efficiency gains.

2019 guidance:

Capex range of $6.1B-6.5B

More capital allocated for new areas (less for established areas)

12-16% production growth (consensus was for 17%), assuming oil at $50 per bbl

Cash flow priorities:

1/ dividend growth (above 19% CAGR historical)

2/ $3B debt reduction (2018-2021)

3/ lower cost property additions (meeting premium returns criteria)

4/ share repurchases

EOG Thesis:

- EOG is attractively valued relative to future cash flow growth and return potential

- As the leading North American Oil production company, EOG is well positioned to benefit from (1) Secular growth in US shale production and (2) Cyclical rebound in global oil production/oil prices

- We view EOG as a high quality company within a highly cyclical industry – EOG has generated 13% annual Returns on Invested Capital over the past 10 years and offers industry leading cash flow growth potential

- Though not immune, EOG’s stock protects better than most energy stocks on the downside due to its high quality nature – strong balance sheet, ROIC, & cash flow generation

- As such, we view EOG as offering the potential for superior risk-adjusted returns over a market/commodity cycle

$EOG.US

[tag EOG]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109