Why is the stock down?

There has been multiple events pushing the stock down:

· Omnicare underperformance that led to an additional write-down in 4Q18

· Loss of the Centene and WellCare business as those two clients merge and will bring the PBM in-house

Outside of their control:

· Democrat’s push for Medicare-for-all would impact health insurers (and recent Aetna acquisition)

· Removal of the rebates practice in the government side of the PBM business (CVS is #3 in this space)

· Drug Pricing Transparency Act: this bill would force PBM to pass all rebates to the point of sale and no longer be kept by PBM and/or health insurers

· Push to repeal Obamacare back in the news

· Walgreens had bad earnings and cut their 2019 forecast, pushing the sector down

Why remain invested in CVS?

1/ We find CVS’s long-term strategy of vertical integration compelling:

· This can truly help CVS differentiate themselves from competitors by offering a powerful value proposition, leveraging its network and developing predictive data analysis that will help them lower costs of care

· A similar strategy was successfully implemented by UNH who saw nice margins growth after the integration of Catamaran (PBM)

2/ Retail store footprint combined with MinuteClinic and their new HealthHub concept could become a great growth engine for CVS:

· The retail stores ($19.7B in sales, >10% of total sales) have suffered from lower foot traffic following the removal of tobacco sales

· Offering customers another reason to visit the stores/pharmacy thanks to their new Health & wellness concept (to become 20% of the square footage of the store) could revive traffic

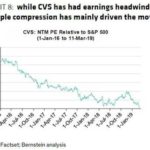

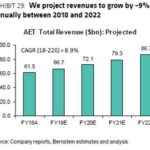

3/ Valuation: we see a disconnect between today’s stock price and the value of its businesses:

· Our sum-of-the-parts and cash flow analysis both show an attractive risk/reward profile

We are currently reviewing our position size for this stock.

[tag CVS]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109