Crown Castle International Corp. (CCI) had another strong quarter, reflecting the significant demand for shared infrastructure assets and positive execution by the team. While FFO was lower than street expectations, site rental revenues and adjusted net income came in higher than expected. CCI kept its full year expectations for revenues, EBITDA and AFFO unchanged. The higher levels of tower leasing experienced in the back half of 2018 continued in the first quarter, and CCI expects to nearly double its small cell fiber deployment in 2019. CCI is pursuing the expanding small-cell opportunity by focusing on top markets where there is greatest potential demand. The playbook is similar to towers in that they are providing fiber solutions and establishing common asset sites across their customer base. By increasing the number of users on an individual small cell site, they are incrementally increasing cash flow and, in turn, dividend yield for its investors.

Current Price: $122 TTM Return: 18%

Target Price: $125 Position Size: 2%

Thesis intact, highlights on the quarter:

Rental revenue continues to grow:

- Q1 total site rental revenue up 6% YoY

- Site rental revenues grew $66 million relative to Q1 2018

- Included $65 million in organic growth, $1 million increase in straight line revenues

- Organic contribution to site rental revenue represents approximately 5.7% of growth

- Approximately 9.5% growth from new leasing activity net of 3.8% from tenant non-renewals

- New leasing activity is accelerating. Lease-up on small cells about 2x the rate they experienced on towers.

- Churn remains low at 1-2%.

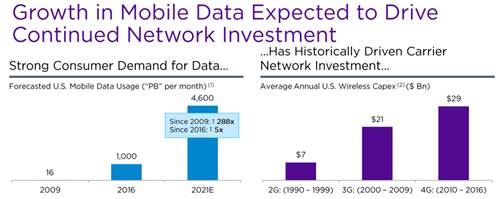

Consumer demand for data drives investment spending by carrier networks:

- Big 4 carriers make up 90% of site rental revenue – AT&T, Sprint, T-Mobile and Verizon.

- CCI small cell pipeline in 2019 is 10 – 15 thousand nodes

- CCI’s outlook on fiber and small cells reflects carriers’ deployment of new spectrum and densification of their networks in preparation for 5G

- There is a potential risk in lost revenue if T-Mobile and Sprint were to merge

- Exposure to T-Mobile and Sprint accounts for 19% and 14% of overall revenue respectively

- Overlapping tenancy between two carries accounts for about 5% of revenue with average of 5-7 years left on the contracts

- It is possible that a merger could lead to immediate investment by Verizon and AT&T in order to keep pace with any synergies established by the merger

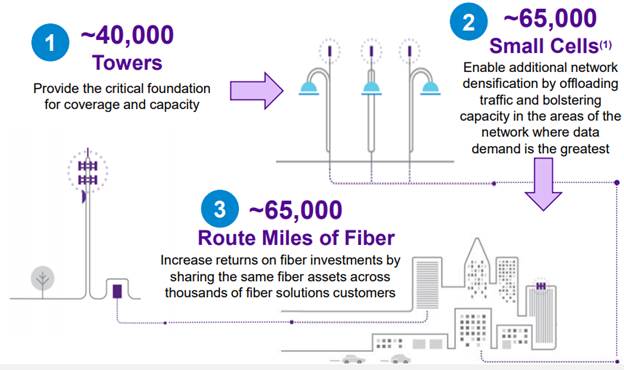

CCI has a leading portfolio mix of shared communication infrastructure assets

- CCI continues to deploy capital toward fiber investments; first tenant yields 5-6% while a second tenant will yield 10-12%

- Fiber opportunities providing long term opportunity for high growth

- Assets have capacity to support organic growth and high incremental margins.

- Return assumptions on these fiber asset acquisitions based on current applications, i.e. new technologies like 5G, IoT, augmented and virtual reality would be upside

- These technologies all would rely on CCI infrastructure assets for higher speed and lower latency requirements.

- Attractive shared economic model in small cell business. Lowest cost and fastest time to market for their customers.

- Multiple ways to monetize fiber assets improves returns and lowers cost and value proposition to customers.

Valuation:

- Strong AFFO growth will drive the valuation (up 9% yoy). They have a 10 year AFFO CAGR of 14%.

- High incremental margins means AFFO growth should outpace or be in line with site rental revenue growth.

- Low maintenance capex (~2% of revenue) supports high AFFO margins.

- Expected $2.413B in AFFO ($5.80/share) in 2019 is a yield of just under 5%. This is an attractive yield given the secular growth potential.

The Thesis on Crown Castle:

1. CCI is well positioned to capitalize on secular mobile data demand growth and small cell/urban opportunity.

2. Strong competitive position. Leading US tower company.

3. Toll booth business – offensive (secular growth) & defensive (4% dividend & contracted cash flows) characteristics.

4. Revenues derived from long term contracts with price escalators and good visibility.

$CCI.US

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109