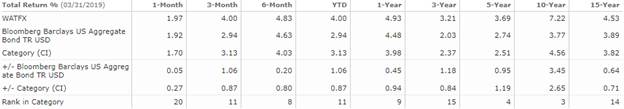

WATFX – Q1 2019 Commentary

Western Asset had a strong quarter outpacing the Agg by over 100 bps. The fund was helped by its quality credit exposure and slightly extended duration relative to the Agg. The team believes that U.S. growth should continue at a moderate pace and is looking for international developed countries to improve their economic outlooks.

Market Overview:

– U.S. Treasuries generated a positive return during the first quarter of 2019 as did spread sectors

o U.S. Treasury yields declined during the quarter driven by the dovish pivot by the Fed

– U.S. fourth quarter 2018 GDP annualized growth was 2.2% versus its previous 2.6%

o Moderating growth in the quarter was attributed to deceleration in private inventory investment, PCE and federal government spending

o These were partially offset by an upturn in exports and an acceleration in nonresidential fixed investment

– Labor market remained tight during the quarter as it was 4% in January and dipped to 3.8% in February, unchanged in March

– Manufacturing sector continued to expand modestly during the first quarter

o PMI expanded for the 31st consecutive month in March with 16 of 18 industries measured by PMI expanding

– After four rate increases in 2018 the Fed kept its target rate unchanged during first quarter

o In March most FOMC members indicated that they did not feel additional rate hikes would be needed in 2019 and indicated only one hike in 2020

– Both long and short term Treasury yields declined during the first quarter

– During the quarter the Agg returned 2.94% as spread sectors rallied

Performance Overview:

– The fund generated positive returns and outperformed the benchmark during the quarter

– An allocation to the investment grade bonds was the largest contributor to performance

o Spreads tightened during risk on environment

o Top performers were Wells Fargo, Goldman, and Bank of America

– Longer duration position was benficial as rates moved lower across the curve

– Allocation to U.S. denominated EM bonds was beneficial

– Exposure to non-agency RMBS was slightly additive for results

– On the downside, yield curve positioning detracted from results

o Mars Inc. was a modest headwind for results

– The team increased its allocation to agency mortgage-backed securities and EM debt

o Reduced exposure to U.S. Treasuries and non-agency RMBS

Market Outlook:

– Continue to believe that U.S. and global expansion will continue at a very slow pace

o This is supported by accommodative global central banks

– Continuing primary focus by monetary policymakers will be the need to extend the expansion

– While U.S. growth moderates slightly, believe that Europe and EM economies will regain their footing

– Believe that the most underappreciated theme continues to be extraordinarily subdued inflation rates around the globe

o We are nine years into the U.S. expansion and the inflation rate has yet to reach the 2% target set by the Fed

o Below trend inflation allows central banks the long leash to get and/or keep interest rates low and hikes are off the table until growth moves fast enough

– Need to monitor further downside is acute but some factors that drove last year’s extreme pessimism are fading

– Prospects for a dampening in trade tensions seem to be in store

o Politics of slamming China publicly played well as long as there was little actual or perceived cost

– Believe the severe underperformance of spread sectors to global sovereign bonds last year presents a meaningful opportunity

o The expectation or fears of further slowing growth and further Fed tightening may be misplaced

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109