Current Price: $160 Price Target: Raising to $185 from $160

Position Size: 3.8% TTM Performance: 32%

Visa continued to perform well in the second quarter with better than expected revenue and EPS. Net revenues were up 9% (constant currency), dampened by higher client incentives. EPS was $1.31 vs consensus $1.24. They reaffirmed full-year 2019 net revenue growth of "low double-digits" on nominal basis and slightly increased adjusted EPS growth to "high-end of mid-teens," from "mid-teens.” Slight weakness in the quarter was that volume growth decelerated from 11% to 8%. Mgmt said volume growth was impacted by fewer processing days in the quarter and timing of Easter. Processed transactions continued to see double-digit growth. Last quarter they expressed concerns around weakening non-US macro trends and cross border transactions, but this quarter they struck a more positive tone, indicating that cross border had stabilized. Cross border accounts for ~27% of gross revenue and is higher yield. In the first few weeks of Q3, payment vols have accelerated, especially in the US.

Key Takeaways:

· They had 47 billion transactions on their network driving >$2T in total volume.

· 2Q payments volume growth +8%, a deceleration from +11% last quarter. Processed transactions +11%, $32.5B

· US payments volume growth was 8%, about 2.5 points lower than last quarter. Approximately 1.5 points of the slowdown is driven by fewer processing days this quarter versus the prior quarter, as well as the timing of Easter. Lower fuel prices contributed about 0.5 point, another 0.5 point was driven by the lapping effects of tax reform i.e, lower withholdings last year and lower or delayed refunds this year, which mostly impacted debit.

· International payments volume growth in constant dollars was 9%. Growth in CEMEA was robust at 22%, with strong growth across Russia, the Middle East and Africa. While growth in the UK slowed 2 points due to weak economic conditions, the rest of Europe grew 11% with particular strength in Central and Eastern Europe.

· Like last quarter, debit growth (which skews younger and lower income) continues to be stronger than credit growth. Debit volumes up 10%, credit volumes up 7%.

· Cross-border volumes were +4%, this has been weaker, but trends are stabilizing. Cross-border slowdown is largely driven by sluggish outbound commerce from countries with currencies that materially weakened YoY. The Argentinean peso is down 49%. The Russian ruble and the Brazilian real are both down 14%, the Aussie dollar down 9%, the euro down 8%, the pound is down 7%, Canadian dollar is down 5%. This significantly impacted US inbound commerce growth, which remains roughly flat.

· Total cards outstanding up 3% to 3.4B. One third credit, two thirds debit.

Valuation:

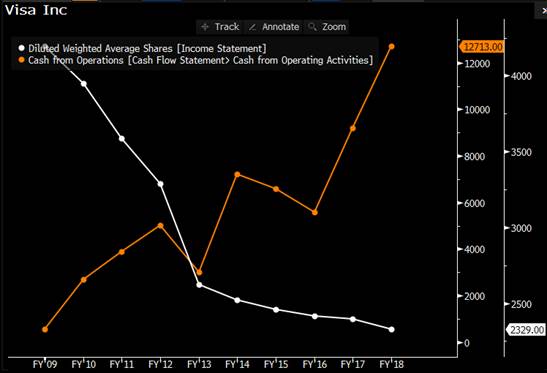

· Strong FCF continues to support buybacks.

· Adjusted free cash flow of $2B for 2Q. YTD FCF of $5B and returned $5.5B to investors through stock buybacks of $4.4B and dividends of $1.1B.

· Trading at a ~4% FCF yield. Reasonable for a company w/ >50% FCF margins, high ROIC, and, absent a recession, should continue growing top and bottom line double digits.

Thesis:

· Visa is the number one credit and debit network worldwide – accounting for about half of all credit and roughly three fourths of all debit card transactions.

· We are still in the earlier innings of the digitization of electronic payments. This is a secular tailwind supporting Visa’s growth as 1.) Electronic payments continue to replace cash 2.) Commerce moves online 3.) Consumer spending grows globally

· Visa’s asset light “toll both” business model is characterized by recurring revenues, high incremental margins, low capital expenditures, and high free cash flow.

· Visa’s recent acquisition of Visa Europe should be a nice tailwind over the next few years as the European market is in the earlier stages of electronic payment adoption and Visa is well positioned to gain market share and improve margins in the region.

$V.US

[tag V]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!