BEXIX – Q1 2019 Commentary

The Baron Emerging Markets Equity Fund outperformed its benchmark during the quarter as EM equities bounced back to start the year. Many of the most impaired names recovered and Baron had incremental gains in all but two equity sectors. Baron believes that China will continue to surprise on the upside in 2019 helping drive broad EM performance.

Market Overview:

– Baron believed at end of 2018 that a rally in global equities was more likely than a further decline, as we have seen in Q1

– Also said that should the outlook for trade policy reduce pressure on China many of their investments offered material upside from current levels

o The recent reversal is largely justified as policy and economic tail risk have de-escalated and China has incrementally introduced targeted stimulus measures

– During the first quarter many of the most impaired equities and currencies staged impressive recoveries though most still remain below highs

– The team believes that China will continue to surprise to the upside this year

– Additionally, they see continued recovery in Brazil and Pakistan, both relative over weights

Performance Overview:

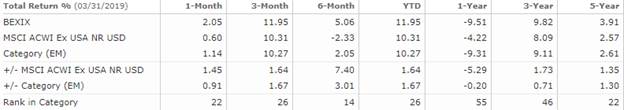

– The fund returned 11.95% during the quarter and outperformed its EM benchmark by 202 bps

o Driven by favorable stock selection across countries and sectors

– On a country basis, Brazil and China added nearly 275 bps of relative performance

o These were somewhat offset by adverse stock selections in India and higher exposure to this lagging country

– On a sector level, outperformance in tech, health care, comm. Services, and industrials contributed to relative performance

o Stock selection in tech added more than 135 bps to relative performance

– Largest individual contributors included Chinese retailer Alibaba Group, Brazilian payment processer PagSeguro, and China-based pork processor WH Group Limited

– The largest individual detractors included Indian battery company Exide Industries, South Korean financial services KB Financial Group, and Tata Chemicals Limited

Market Outlook:

– The team is increasingly confident that we are at an inflection point in market leadership

o EM and currencies can begin a period of sustained outperformance

o Less confident in the near-term outlook for the U.S. economy, corporate earnings, and equities

– While global equities have repriced to reflect declining policy tail risks and now discount forward Fed rate cuts they suspect the Fed’s shift to neutral also suggest rising risks to U.S. economy

– China’s increasingly aggressive response to weak domestic conditions suggests a bottom and enhanced forward looking earnings

o Believe that U.S. corporate earnings expectations are moving through peaking process

– U.S. equity performance has outperformed international on strength of domestic consumption, fiscal stimulus, and tax-incented investment

o believe we are likely entering a period of mean reversion with performance

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109