Key Takeaways:

Current Price: $91 Price Target: $115 (NEW)

Position Size: 1.8% 1-year Performance: -23%

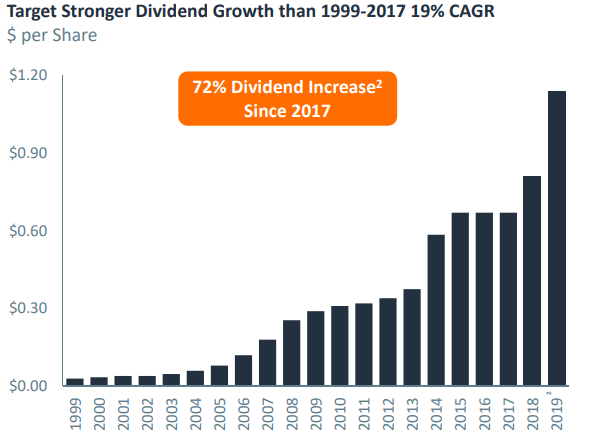

EOG released 1Q19 earnings with production levels ~1% above the top end of its forecast, giving some reassurance that they are well on track to deliver on current estimates for 2019. EOG mentioned on the call having 13 years of premium well inventory. Oil production was 20% higher than 1Q18. Increased efficiencies are driving better results at a lower cost, boosting earnings results. Adjusted EPS was 15% above guidance. Capex will be $6.3B for the year and will boost production by 12-16% in 2019 (as previously guided). EOG will use its FCF to strengthen its balance sheet, planning to repay $500m in debt, and $3B total between 2018 and 2021. The company is also boosting its dividend by 31%, a sign that the management team thinks cash flow will remain consistent going forward.

2019 guidance update:

Volume and capex guidance unchanged

EOG Thesis:

- EOG is attractively valued relative to future cash flow growth and return potential

- As the leading North American Oil production company, EOG is well positioned to benefit from (1) Secular growth in US shale production and (2) Cyclical rebound in global oil production/oil prices

- We view EOG as a high quality company within a highly cyclical industry – EOG has generated 13% annual Returns on Invested Capital over the past 10 years and offers industry leading cash flow growth potential

- Though not immune, EOG’s stock protects better than most energy stocks on the downside due to its high quality nature – strong balance sheet, ROIC, & cash flow generation

- As such, we view EOG as offering the potential for superior risk-adjusted returns over a market/commodity cycle

$EOG.US

[tag EOG]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109