To date, 78% of the companies in the S&P 500 have reported actual results. So far, sales and earnings growth expectations for the quarter have improved.

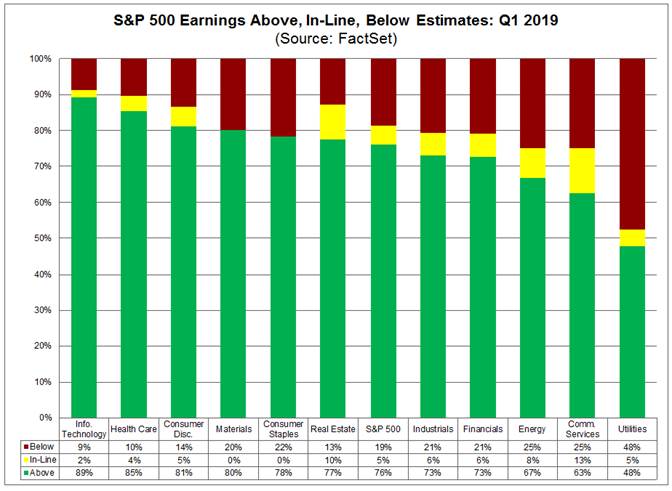

· 76% of companies have beat on EPS, above the 5 year average. 60% have beat on sales, also above the 5 year average.

· The blended revenue growth rate for Q1 2019 is 5.2%, which has slightly improved.

· The blended earnings decline for the first quarter is -0.8%. Before companies started reporting results, Q1 EPS was expected to be down ~3.5%.

· Positive earnings surprises reported by companies in multiple sectors (led by the Health Care sector) were responsible for the decrease in the overall earnings decline.

· 6 sectors are reporting YoY growth in earnings, led by the Health Care and Utilities sectors. 5 sectors are reporting a YoY decline in earnings, led by the Energy, Tech, and Communication Services.

· 9 sectors are reporting YoY growth in revenues, led by the Health Care and Communication Services.

· For CY 2019, analysts are projecting earnings growth of 3.6% and revenue growth of 4.7%.

· The forward 12-month P/E ratio is 16.8. This P/E ratio is above the 5-year average of 16.4 and above the 10-year average of 14.7.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109