MWTIX – Q1 2019 Commentary

The MetWest Total Return Bond Fund outperformed the Barclays Agg during the quarter as they were helped by duration positioning and legacy asset backed positions. The team believes that the Fed has indicated its future course of action may be swayed by market movements, and we could have possibly reached the end of the current hiking cycle.

Market Overview:

– After the end of 2018 when risk markets tumbled and Treasuries rallied, it took only a few days into the new year for a dovish Fed pivot to change sentiment

o Late January meeting ended with unchanged Fed Funds rate and a substantially softened message

– Risk assets then ended the first quarter in strong positive territory as the S&P 500 gained 13.6% while the Agg returned only 2.9%

– In the U.S. the effects of fiscal tax stimulus have abated on a year over year basis and there have been additional drags on growth

o Government shutdown, manufacturing and housing and auto sales slowed

– Growth concerns in Europe reverberated as manufacturing disappointed

– Chinese growth faded and the OECD once again trimmed its global growth outlook to 3.3%

– Global Central Banks took their cues from the Fed as we saw accommodative policy from the ECB

– Up move in valuations after the Fed pause were keeping with post-crisis norms

– Fixed income corporates drove performance in the risk on markets

o Investor unease remained under the surface as lesser rated bonds did not start the year off as well as higher credits

– Securitized sectors also recovered from Q4 softness though generally trailed credit

Performance Overview:

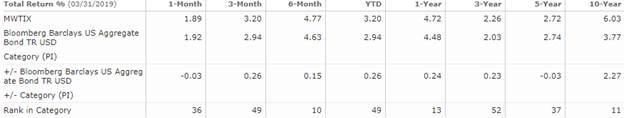

– MWTIX gained 3.2% in the first quarter outpacing the Agg by 26 bps

– Given the disciplined lengthening of duration relative to the Agg, performance benefited in the yield decline over the last four months

– A defensive posture in credit weighted on returns but was balanced by solid gains in communications and non-cyclical holdings that were emphasized in broad exposure

– Further contributions from the legacy non-agency residential MBS positions held steady and added to relative performance

– Final plus to relative performance owed to an overweight of Freddie collateral within the Agency MBS exposure

Market Outlook:

– The Fed’s surprisingly dovish start to the year effectively signaled that this might just be the end of the hiking cycle

o Their recent capitulation to the markets has yet again demonstrated that markets may dictate future Fed course of action

– The inverted yield curve indicates that bond investors have a distinctively cautious view of future growth which stands in stark contrast to the recent equity rally

o This weighs on banks’ willingness to extend credit as net interest margins are pressured

– Overall sector positioning remains defensive with corporate emphasis on defensive sectors

– Non-agency MBS continues to present attractive risk-adjusted return opportunities despite a shrinking market

o Agency MBS offers better liquidity characteristics but here is risk as the Fed continues to shrink its balance sheet

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109