HLMEX – Q1 2019 Commentary

The Harding Loevner Emerging Markets Fund outperformed its benchmark during the quarter driven primarily by strong stock selection. The team held onto names that were out of favor at the end of 2018, and these positions bounced back to help the fund return over 14%. The team continues to focus on picking growth oriented names with sustainable long term investment advantages.

Market Overview:

– Emerging markets rose sharply during the quarter

o Boosted by sings of progress in U.S. – China trade negotiations, favorable economic data from China, and a new dovish tone from the U.S. Federal Reserve

– Officials in Washington and Beijing described the trade talks as promising and backed off from threats to impose further tariffs

– China markets soared 18%, contributing 70% of Asia’s overall return

o No other region produced double digit gains during the quarter

– In Latin America, the improving outlook for Chinese growth lifted energy and metal prices boosting the markets of Columbia and Peru

– Europe’s 8% return was primarily a result of a 12% gain in Russia

o Rising global energy prices boosted energy and financial stocks

– Consumer discretionary performed best followed closely by real estate, tech, and energy

Performance Overview:

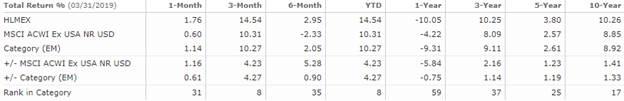

– HLMEX outperformed its benchmark during the quarter by almost 400 bps

– The strategy was rewarded by maintaining positions in stocks that were beaten down at the end of 2018

o Invested in new companies in the IT and consumer sectors, and reduced exposure to Chinese Health Care

– The portfolio outperformed in nearly every sector as the headwind shifted to a tailwind for the preference toward growth companies

– Holdings within IT and financials provided nearly 100 bps of excess returns in each sector

– Consumer discretionary stocks detracted from relative returns

– On a geographic basis, relative contribution in China, South Korea, and Taiwan

o Largest relative detractors were India and South Africa

– Portfolio activity was subdued in the quarter as it was during the prior quarter’s selloff

o Remind holders that “doing nothing” is an active decision

o This impacts portfolio results just as much as new positions without incurring trading or implicit costs

Market Outlook:

– Companies worldwide are experiencing a digital transformation

o Projects to improve their operations and capture growth opportunities

o Goal is to improve returns on capital

– Returns from such projects may be greatest for companies in developing countries

– In regions with large and geographically dispersed populations and less developed physical infrastructures identify, segment and then reach their target markets

– The portfolio includes numerous companies whose bright growth prospects depend directly on their well-conceived digital initiatives

o Ping An Insurance is China’s second largest insurer

o EPAM, global software provider

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109