TIREX – Q1 2019 Commentary

The TIAA CREF Real Estate Fund outperformed its REIT benchmark during the quarter as nearly all real estate sectors posted double digit returns. The team continues to focus on long-term, growth oriented stocks with superior balance sheets. Improvements in the U.S. economy including wage gains and positive employment numbers are positives for REITs.

Market Overview:

– In January, just six weeks after signaling two interest rate hikes for 2019 the Fed dropped all references to planned rate increases

o Two months later the Fed indicated that zero rate hikes were expected this year

o This created a great environment for stocks, especially REITs

– U.S. stocks then enjoyed robust first-quarter rebound after the prior period’s steep selloff

o REITs topped the S&P 500 Index for the second consecutive quarter and all but two sectors within REITs posted double digit returns

– U.S. economy showed signs of moderating but still healthy growth

o Continued gains in employment and wages which are generally positive for real estate

Performance Overview:

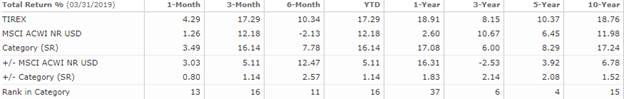

– The fund slightly outpaced its FTSE NAREIT Index during the quarter returning 17.29%

– A number of fund holdings that declined sharply in the fourth quarter of 2018 recovered most, if not all, of their losses

– Largest individual contributor during the period was GDS Holdings

o Provider of high performance data center infrastructure services in China

– On a relative basis, the fund was helped being underweight Public Storage

o Was up for the quarter but lagged the total return of the REIT index

– Largest individual detractor was an underweight to American Tower Corp.

o Fund’s second largest rallied on positive fourth quarter earnings results

– Simon Property and CyrusOne were relative detractors as their performance was flat during an extremely strong quarter for REITs as a whole

Market Outlook:

– The team’s focus remains to be on long-term, growth oriented REITs with superior balance sheets, such as single-family rentals, industrials and data centers

– The fund continued to strategically take profits and reallocate the proceeds across a number of sectors

o This included apartments, infrastructure, and manufactured housing

– REITs are now more fairly valued on an absolute basis but still look attractive on a relative value basis compared to the broad equity market

– REITs continue to offer solid overall fundamentals and have defensive characteristics such as cash flow and inflationary resistance

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109