Key takeaways:

Current price: $131 Price target: $139

Position size: 2.40% 1-year performance: +23%

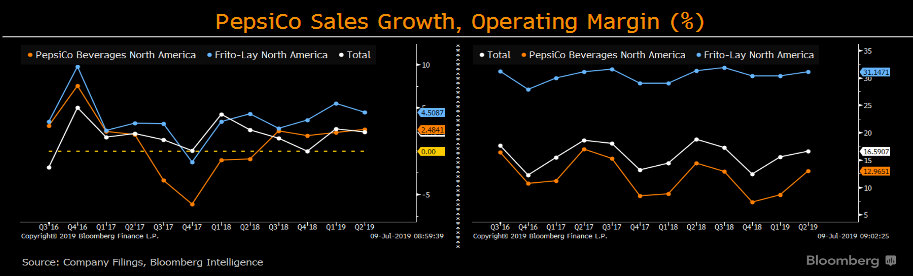

Pepsi reported +4.5% of organic revenue growth (+2.2% revenue growth), thanks to strong performance from Frito-Lay. Contrary to last quarter, PEP had broad-based revenue growth in all geographies and divisions. Continued growth has been boosted by recent investments in the brands, which the CFO sees as sustainable in the long term. The management team did not increase its 2019 guidance as commodity inflation remains a risk and investments spending is being made in its manufacturing and supply-chain footprint. Its recent drink bubly (introduced last year) is doing well, reaching almost $300M in sales with 11% market share, that is projected by Pepsi to become a $1B in sales in the future. Pepsi and Mountain Dew are turning around after a tougher 2018.The stock has been strong year-to-date so we are not surprised to see it not move higher on solid, but expected results today.

Pepsi’s CFO comments on the US consumer are positive, telling CNBC he did not see any signs of a slowdown in the US. The Middle East and Brazil are still challenging regions, but overall globally thanks to low interest rates, business continues to do well.

Regarding ESG initiatives, Pepsi announced it will reduce its use of virgin plastic for packaging water, moving to 100% recycled plastic for its Lifewtr brand, while also testing canned water with Aquafina. It’s a small step in the right direction.

Segments growth review:

· Frito-Lay North America organic growth +5%

· Quaker Foods North America organic growth +3%

· Pepsi Beverages North America organic growth +2%

· Latin America organic growth +10%

· Europe Sub-Saharan Africa organic growth +5%

· Asia, Middle East and North Africa organic growth +5%

Valuation: maintaining our $139 price target

[tag PEP]

$PEP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109