Key Takeaways:

Current Price: $172 Price Target: $177

Position Size: 1.83% 1-year Performance: +16.5%

UNP reported a 2% revenue decline, but this negative was countered by an operating ratio improvement of 340bps, an all-time quarterly record despite weather related challenges (60bps drag). Total volumes were down 4% but pricing up 2.75%. UNP continues its focus on asset utilization, improving its locomotives productivity (+19% this quarter). UNP expects 2H volume to be down 2% (worse than previously thought) but continued pricing gains. Operating ratio guidance is positive reaching under 61% in 2019, and below 60% in 2020. The company now expects 2019 workforce reduction of 10%.

Adjusted net debt/EBITDA has increased in the past year, now reaching 2.5x, something to keep an eye on if volumes continue to decline.

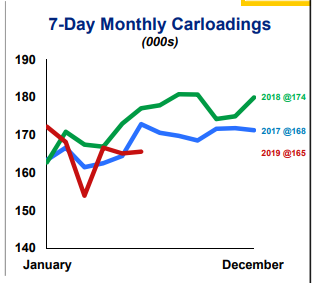

The red line in the chart below (2019 carloads) is one of the reason we trimmed UNP earlier this year.

Investment Thesis:

1. Pricing power: Railroads offer 4x the fuel efficiency of trucking per ton-mile of freight – a secular tailwind

2. History of compelling long term shareholder returns

3. Industry leading operating ratio and improving ROIC driving returns to shareholders via dividends/buybacks. Real shareholder yield of 6.5% (2.5% dividend yield, 4% buyback)

[tag UNP] $UNP.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109