Key takeaways:

Current Price: $352 Price Target: $388

Position Size: 3.85% 1-year Performance: +12%

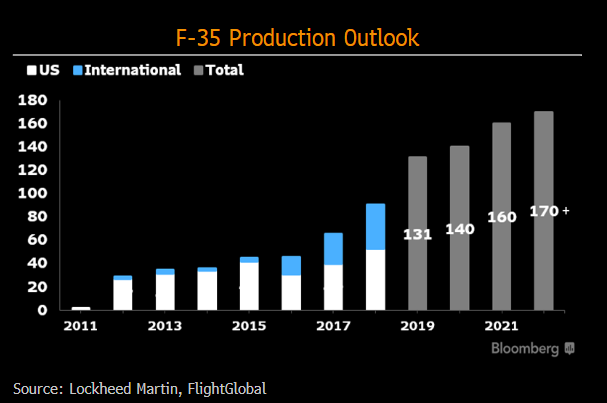

Lockheed’s 2Q19 earnings results were once again good with revenue growth of 8% and EPS +23%, thanks to higher fighter jets and missiles sales. With its bookings trend still positive (1.22X book to bill in the quarter, a good indicator for future demand), the revenue growth continues to look sustainable for the rest of the year. Margins expanded 80bps. While the US Government decided to suspend the F-35 deliveries to Turkey, this only represents about 8 planes/year for a total of 100 planes (131 F-35 will be delivered this year, see graph below for out years schedule). There should be minimal supply chain disruptions on the F-35 production from the Turkish situation. Production costs continue to come down as volume goes up and LMT finds opportunities to improve the program’s profitability. Overall this was a solid quarter. A raise of its full year guidance confirms the strength of LMT’s portfolio.

2019 Guidance raised on strong performance across the portfolio:

Sales guidance increased by +3%

Mid-point segment margin increased by 10 bps

EPS $20.85-$21.15 which represents a 4% increase from prior guide of $20.05-20.35

Cash from ops at least $7.6B (vs. $7.5B previously)

LMT Thesis:

· Lockheed Martin is a primary beneficiary from the replacement cycle for aging military aircraft and ships

· Excellent management team focused on returning capital to shareholders

· Strong cash flow and financial position

[tag LMT] $LMT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109