Current Price: $488 Price Target: $540

Position Size: 3.2% TTM Performance: +8%

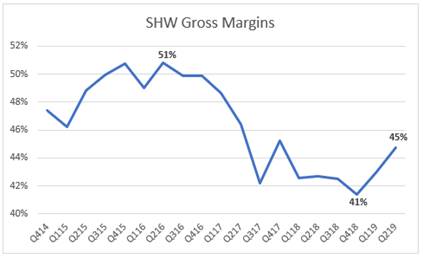

SHW missed slightly on revenue and beat on EPS. The stock is up on better margin outlook and impressive paint stores SSS performance. Margin improvement is expected with re-affirmed full year EPS guidance despite lowered sales guidance. Gross margins improved as recent pricing actions are gaining traction to offset raw material inflation. They expect continued GM improvement on stronger volumes and lower YoY raw materials. Biggest margin improvement in Consumer Brands Group and Performance Coatings, which drove the beat. They also reported strong +4.3% SSS in the Americas Group, an acceleration from last quarter. This was a relief given wet weather, lapping tough SSS, and their competitor, PPG, last week reporting flat SSS in N. America stores.

Key Takeaways:

· SHW is set to benefit from higher product prices, good volume growth, falling raw material costs and an improvement in housing.

· They continue to see softness in Asia and Europe.

· The Americas Group: 55% of sales, +5%

o SSS +4.3%

o Higher paint sales across all end markets in N. American stores and price increases.

o Segment margins increased 50bps.

o Opened 20 net new stores year to date.

o Professional painting contractor customers continue to report solid backlogs and project pipelines going forward.

· Consumer Brands Group: 16% of sales, +3.4%

o Growth due primarily to a new customer program launched in 2018 and price increases

o FX headwinds(-1.6%)

o Segment profit increased to 17.5% from 11.7% in 2Q last year due primarily to selling price increases, good cost control.

o Sales and profitability improved in N. America and Europe, but were partially offset by softer demand in Asia, Australia & New Zealand.

· Performance Coatings Group: 29% of sales, +3.8%

o Soft sales outside North America and unfavorable currency translation. FX headwinds(-2.7%)

o Segment profit increased to 11.4% from 10.5% in 2Q last year due primarily to selling price increases and good cost control.

o Revenue growth in Packaging and coil was more than offset by softness most notably in industrial wood division, which continues to be impacted by tariffs.

o Geographically, sales were up in Latin America and flat in N. America, offset by softness in Asia and Europe where sales decreased by low-double digit and mid-single digit percentages respectively.

· Guidance implies margin improvement:

o FY sales guidance lowered from +4-7% to +2-4%.

o Reaffirmed full year 2019 adjusted diluted net income per share guidance to be in the range of $20.40 to $21.40 vs $18.53 in 2018.

Valuation:

- Expected free cash flow of ~$2B in 2019, trading at ~4.5% FCF yield.

- Given growth prospects, steady FCF margins and high ROIC the stock is undervalued. They deserve a premium multiple based on large exposure to the N. American paint contractor market and no exposure to the cyclical sensitive auto OEM end market.

- Balance sheet leverage from the Valspar acquisition continues to improve; they expect to get to under 3x by the end of the year.

- Buybacks should accelerate as Sherwin returns to its historical capital allocation.

Thesis:

- SHW is the largest supplier of architectural coatings in the US. Sherwin-Williams has the leading market share among professional painters, who value brand, quality, and store proximity far more than their consumer (do-it-yourself) counterparts.

- Their acquisition of Valspar creates a more diversified product portfolio, greater geographic reach, and is expected to be accretive to margins and EPS. The combined company is a premier global paint and coatings provider.

- SHW is a high-quality materials company leveraged to the U.S. housing market. Current macro and business factors are supportive of demand:

- High/growing U.S. home equity values. Home equity supportive of renovations.

- Improving household formation rates off trough levels (aging millennials).

- Baby boomers increasingly preferring to hire professionals vs. DIY.

- Solid job gains and low mortgage rates support homeownership.

- Residential repainting makes up two thirds of paint volume. Homeowners view repainting as a low-cost, high-return way of increasing the value of their home, especially before putting it on the market.

$SHW.US

[tag SHW]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109