HILIX – Q2 2019 Commentary

The Hartford International Value Fund outperformed its benchmark during the quarter and maintains its strong relative long term performance numbers compared to peers. Value continues to underperform growth and quality in developed international markets but both of those factors are becoming more and more expensive on a historical valuation basis.

Market Overview:

– International equities as measured by the MSCI ACWI ex-USA rose for the second straight quarter

– Sluggish global growth and geopolitical events dominated headlines

o Trade tensions between China and the United States escalated in May but eased at the end of the quarter

o The two countries agreed at the G20 summit to resume trade negotiations

– President Trump announced the existing tariffs would remain in place but suspended tariffs on an additional $300 billion of Chinese goods

– In Brexit, was a major concern, with the UK avoiding an abrupt no-deal departure from the EU in April after EU leaders granted the UK a flexible extension until October

– On the monetary front, dovish central bank rhetoric and policy bolstered global markets

o Fed signaled it was open to rate cuts amid concerns about downside risks

o ECB hinted that it may lower rates if the outlook for growth and inflation fails to improve

Performance Overview:

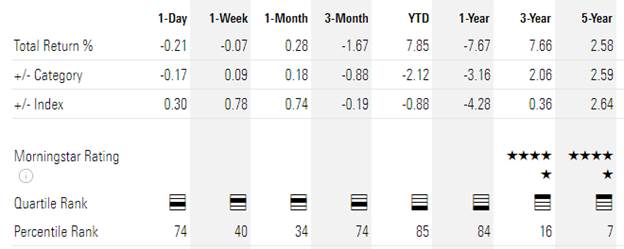

– The Hartford International Value Fund outperformed its MSCI Value benchmark this quarter

o Outperformance was driven primarily by sector allocation, indirectly driven by the stock selection process

– Stock selection detracted from relative results within consumer discretionary, financials , and communication discretionary, financials, and communication services

– Holdings in China, Australia, and Germany legged the most, while holdings in Russia and South Africa performed best

– Value significantly underperformed growth creating a continued headwind for the strategy

o Valuation of value in non-US markets is close to the 15th percentile of low cost versus history compared to growth and quality

o Growth and quality are in the 94th and 99th percentile of “expensiveness” respectively

– Among the top contributors were Gazprom and Gold Fields Limited

– Top detractors during the period were Innolux Corporation and China Unicom

Market Outlook:

– The team continues to focus on opportunities that fit into the framework of looking for stocks with low relative price, low expectations, and low valuations that generally feature strong balance sheets and significant potential upside

– Energy, communication services, financials, and materials remain the largest overweight exposures and consumer staples and healthcare are largest underweights

– During the quarter the team initiated ten new positions and eliminated seven positions

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109