Key Takeaways:

Current Price: $47 Price Target: $61

Position Size: 1.88% 1-year Performance: -10%

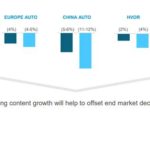

Sensata released disappointing 2Q19 results, with organic sales of -1.6%, below management’s guidance of -1% to +2%. ST lowered its 2019 sales guidance by 3% due to lower end market growth assumptions in auto, HVOR and industrial. In 2Q19, the China auto industry was down 20% and European auto down 10%, much lower than anticipated. Despite weak top line, operating margins remained flat as the company actively managed its expenses and benefited from capital deployment initiatives. Additional actions are being put in place to align its cost structure to the lower market demand, as well as other restructuring actions (2 years payback on the restructuring already started).

Sensata reduced its market assumptions again:

· global auto market: -5%; vs -3% to -4% before

· China auto: -11% to 12-%; vs. -5% to -6% before

· European auto down 4-5%; vs. -4% before

o The auto slowdown is being offset by continued content growth such as electric vehicles battery subsystems

· Industrial -6%; vs. -1% before

· global HVOR market: -4%, vs. -2% before

On the positive side, Sensata continues to outperform the sectors it plays in, and is advancing its initiatives in the electrification theme (partnership with Lithium Balance). Even though the traditional Chinese auto market slowed down quite a bit, ST has been able to increase content per vehicle, allowing them to be somewhat flat in growth this quarter. They see China as the fastest EV market grower, helping sustain ST’s content growth in the future. Despite a weak quarter, the long-term content growth thesis remains intact, and the incremental $500mn buyback program announced today offers some support to the stock.

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

[tag ST]

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109