Current Price: $46 Target Price: $63

Position size: 4.1% TTM Performance: 7%

CSCO reported strong Q4 results, but guided below expectations for next quarter. Revenue growth guided to 0% to +2% vs street +2.6% and Q1 adj. EPS guided to $0.80c to $0.82 vs street $0.83. Weaker than expected guidance driven by Server Provider end markets (e.g. telecoms) and China. While China is only about 3% of sales, revenue was down 25% in Q4 and is down “very dramatically” in Q1 which mgmt attributed to the trade war and said that with state-owned enterprises in China they are being uninvited to bid. Their Service Provider end markets have been weak for some time, but should improve over time as telecoms spend to build out the core of their networks for 5G. Management’s tone about the macro environment was more negative…” we did see in July some slight early indications of some macro shifts that we didn’t see in the prior quarter.”

Thesis intact, key takeaways:

· Total revenue was $13.4 billion, up 6%. Non-GAAP EPS was $0.83, up 19%. Q4 gross margin was 65.5%, up 2.3 points.

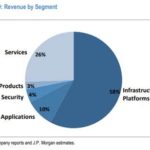

· Infrastructure platforms (largest segment, ~58% of revs) grew 6%. All of the businesses were up with the exception of routing. Switching had a great quarter with double-digit growth with the continued ramp of Cat 9K and strength of the Nexus 9K. Routing declined due to weakness in service provider end markets.

· Applications were up 11% with collaboration, AppDynamics and IoT software all up double digits.

· Security was up 14% with strong performance in identity and access, advanced threat, unified threat and web security.

· Service revenue was up 4% driven by software and solution support.

· They continue to transform their business, delivering more software offerings and driving more subscriptions. Subscription revenue was 70% of total software revenue, up 12pts YoY and 5 points sequentially. This transition will drive an upward trend in CSCO’s margins over the next several years.

· While orders were flat YoY, orders outside of service provider grew mid-single digits. Total product orders growth was flat. By geography, Americas was up 1%,EMEA was up 4% and APJC was down 8%. Total emerging markets were down 8% with the BRICS plus Mexico down 20%. By customer segments, enterprise was down 2%, commercial grew 7%, public sector was up 13% and service provider was down 21%.

· Cisco is helping their customers change their technology infrastructure to accommodate new technologies like cloud, AI, IoT, 5G and WiFi 6. Their evolving portfolio of products help customers navigate this complexity by helping them simplify, automate, and secure their infrastructure. They are in the early innings of evolving network architectures.

Valuation:

· They have a 3% dividend yield which is easily covered by their FCF.

· In their Q2 fiscal ’18 earnings call, they said they would return $31 billion through share repurchases over the following 18 to 24 months. As of Q4 fiscal ’19 they completed that commitment with share repurchases of 32.6 billion. Going forward, they will return to a capital allocation strategy of returning a minimum of 50% of their FCF to shareholders annually through share repurchases and dividends. This indicates much less buyback going forward as their annual dividend is $6B and half of annual FCF would be less than $8B.

· They have ~$9B in net cash. In the quarter they returned $6B to shareholders – $1.5B in dividends and $4.5B in buybacks.

· Forward FCF yield is ~7.5%, well above sector average and is supported by an increasingly stable recurring revenue business model and rising FCF margins.

· The company trades on a hardware multiple, but the multiple should expand as they keep evolving to a software, recurring revenue model. Hardware trades on a lower multiple because it is lower margin, more cyclical and more capital intensive.

Thesis on Cisco:

· Industry leader in strong secular growth markets: video usage, virtualization and internet traffic.

· Cisco is the leader in enterprise switching and service provider routing and one of the few vendors that can offer end-to-end networking solutions.

· Significant net cash position and strong cash generation provide substantial resources for CSCO to develop and/or acquire new technology in high-growth markets and also return capital to shareholders.

· Cisco has taken significant steps to restructure the business which has helped reaccelerate growth and stabilize margins.

$CSCO.US

[tag CSCO]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

PLEASE NOTE!

We moved! Please note our new location above!