Current Price: $50 Price Target: $60

Position Size: 3.4% TTM Performance: 1%

TJX initially traded down after reporting revenue that missed quarterly estimates and guiding below consensus for next quarter. Since the call the stock has recovered as management indicated weather in May dampened same store sales (SSS) results which contributed to the miss. SSS in June and July materially improved. Weak SSS at HomeGoods also contributed to the miss, but mgmt. said that was almost entirely self-inflicted and not really about a weakening macro environment. Additionally, management’s commentary around their inventory positioning eased concerns of bloated inventories (inventory growth outpaced sales growth in the quarter). Full year SSS and EPS guidance maintained.

Key takeaways:

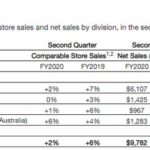

· Revenue missed on same store sales of +2% vs expected +3%.

· Traffic was again the biggest driver of SSS. E-commerce sales are not included in SSS numbers.

· EPS was in-line with expectations.

· Management sees Q3 EPS of $0.63-$0.65, below consensus of $0.68, on same-store sales growth of 1%-2%. In Q3 they are lapping their strongest quarter last year which saw a 7% consolidated comp increase and a 9% comp at Marmaxx.

· In Q2, their core Marmaxx division (60% of revenue) delivered SSS growth of +2%.

· Flat SSS at HomeGoods contributed to the miss – management attributed this to issues in a few categories which they are working to fix. This led to higher markdowns and some margin compression in this segment. Mgmt said 80% to 90% self-inflicted execution issues and very, very, very little macro environment.

· International comp sales grew an impressive 6%. Despite the challenging retail landscape in Europe they continue to take share as many other major retailers across Europe report slower sales growth and close underperforming stores.

· Higher payroll costs and escalating freight expenses from rising home-furniture penetration are margin headwinds

· Merchandise margin was down, but would have been positive ex-freight.

· In terms of inventory, mgmt. said they are “thrilled with the tremendous buying opportunities we see in the marketplace, and are in an excellent position to take advantage of them .”

· When asked on the call about the impact of tariffs they said in the “short term, we believe some of the advantageous buys that we’re making more recently could be due to early delivery of tariff category merchandise.”

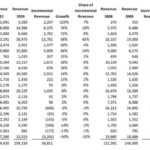

· Chart below demonstrates TJX’s resistance to e-commerce and economic cycles. Despite the ramp in e-commerce share of retail over the last several years, of the companies listed below TJX is nearly half of aggregate incremental spend. The companies listed below represent ~$200B of the $275B in US apparel retail sales. Additionally, in the ’08 to ’09 period they were one of few retailers that continued to grow and post positive SSS.

Valuation:

· Balance sheet is strong. They have no net debt.

· Store openings will bolster top line growth. This fiscal year they plan to add 230 net new stores, representing 5% store growth.

· They have been steadily FCF positive, even through the financial crisis they posted 3% FCF margins. LT FCF margins are ~7%.

· They plan to buyback ~3% of their market cap this year (fiscal 2020).

· Valuation is reasonable at over a 4% forward yield.

· Increased dividend 18%… 23rd consecutive year of dividend increase. Dividend yield is 1.8%.

The Thesis on TJX:

· Market leader: opportunity to benefit from a lasting paradigm shift in consumer frugality. Treasure hunters – TJX has strong brands that attract cost conscious consumers– evident through consistently strong customer traffic.

· Strong bargaining power with suppliers due to size.

· Quality: Solid and consistent execution and top line growth driving strong margins through cost cutting/inventory control.

· Shareholder returns: Strong returns, balance sheet and cash flows being used for share buyback program, dividend, and store expansion.

$TJX.US

[tag TJX]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!