HLMEX – Q2 2019 Commentary

The Harding Loevner Emerging Markets Equity Fund returned 1.84% during the quarter, outpacing the benchmark by 110 bps. The team continues to monitor the ongoing trade war but uses short term price movements to take advantage of valuations on long term growth companies.

Market Overview:

– Emerging markets were flat overall in a volatile quarter

o Marked by further development in the US-China trade dispute, weak economic data, and signs of a dovish monetary policy

– Optimism surrounding prospects for the latest round of U.S.-China trade talks had supported rebounding stock markets in the first four months of the year

o Evaporated when negotiations abruptly dissolved into recriminations

– Further jolt was delivered by the US Commerce Department opening a new front in the conflict by barring U.S. companies from selling advanced semiconductors or other parts to Huawei

– In June U.S. Fed acknowledged rising global risks may have negative affect on U.S. growth

o They signaled further rate hikes were unlikely and eventually cut rates

– Global bond yields have fallen uniformly, as the ECB looks to initiate its next chapter of quantitative easing

o Dovish tone of Central Banks enticed investors back to EM risk assets, and EM currencies rebounded from the lows of May to finish in positive territory

Performance Overview:

– The Harding Loevner EM Fund outperformed the index by 90 bps during the quarter

– Outperformance was driven by combination of generally favorable sector allocations and good stock selection

o Good stock picks in financials and industrial offset weaker ones in communication services, IT, and consumer discretionary

– Shares of Hong Kong listed AIA Group also rose in anticipation of the Chinese government’s plan to accelerate the removal of restrictions on foreign insurance company

– In industrials, Latin American airline Copa Holdings first quarter results were better than expected, helped by declining fuel costs

– Geographically, stock selection in China was a detractor

o Fears of an online advertising slowdown hurt Weibo, a social media platform and online auto buying platform, Autohome

Market Outlook:

– This quarter’s episode of the U.S.-China trade drama featured whiplash-inducing developments ending with a meeting and handshake between President Trump and Xi

o Though latest twist was positive, there still is no trade deal

– New tariffs and trade restrictions imposed over last 18 months continue to be enforced

– The team maintains that it does not make changes to the portfolio based on tweets, headline, and geopolitical predictions

o Need to determine if competitive position of a company can be affected and how could it affect long term growth potential

– Ultimately they need to understand which of the plausible scenarios are discounted in share price and which are not

– Transactions during the quarter were primarily in response to price movements

o An April they reduced exposure to a selection of stocks that had strongly appreciated as investors were cheered by positive developments in trade talks

– Transactions during the quarter were primarily in response to price moves

o Reduced exposure in consumer discretionary and industrials

– Additions during the quarter involved attractively priced companies that are executing their corporate strategies well

o Invested in Coca-Cola HB, Brazil rental company Localiza

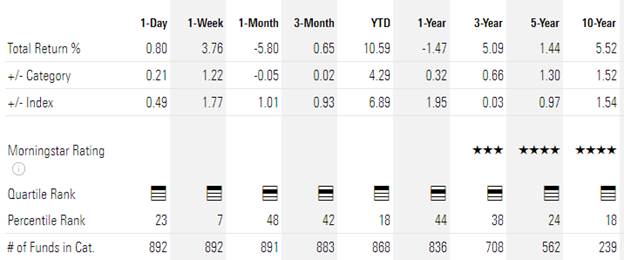

Performance Review:

Peter Malone, CFA

Portfolio Manager

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109